Resin Buying Strategies - August 2010: Commodity Resins Still Falling

The steady decline in commodity resin prices continued last month and into August.

The steady decline in commodity resin prices continued last month and into August. Whereas PE and PP prices now may level off, PS and PVC prices are projected to drop further by resin purchasing consultants at Resin Technology, Inc. (RTi) in Fort Worth, Texas. Here’s more of what RTi experts see ahead.

PE PRICES MAY HAVE BOTTOMED

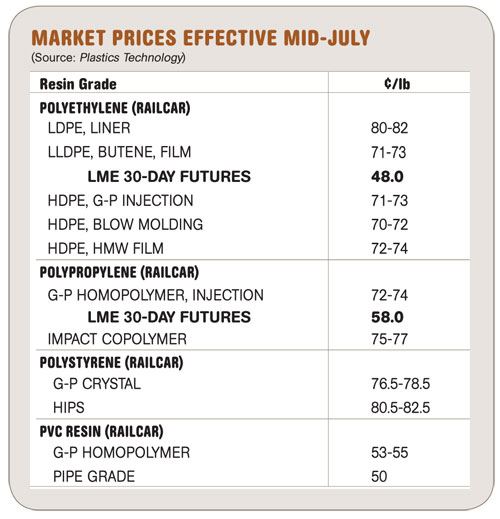

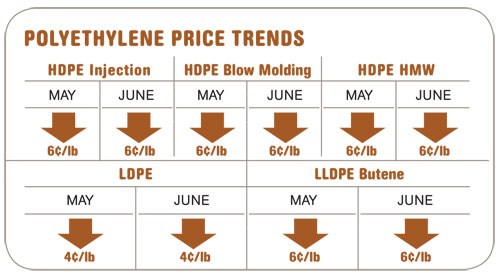

Polyethylene price decreases in May and June erased as much as 12¢ of the 18¢/lb total increases implemented by suppliers earlier this year. HDPE and LLDPE prices dropped 6¢ while LDPE dropped 4¢ in each of the last two months. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film grade in July dropped a penny to 48¢—down 11¢ since April.

While several industry sources were projecting further decreases, RTi foresees flat prices prevailing in July and August. They attribute this to suppliers’ low inventories coupled with an apparent uptick in domestic demand in June/July (perhaps just inventory rebuilding by processors), and the drop in export sales. The outlook for domestic demand is for continued seasonal improvement. Exports could also revive, due to rising prices in Asia.

Spot ethylene prices in June dropped to the mid-30¢/lb range, almost 20% lower than the May average. Resin plant operating rates rose in May and June into the low to high 90s for HDPE and LLDPE, with demand rates of 95% to 97% for HDPE and up to 93% for LLDPE. LDPE remains the exception, with below-normal operating rates of 80% to 83% and demand rates of 95% to 97%. Suppliers’ inventory levels are still below normal.

Outlook & Suggested Action Strategies

30-Day: Buy as needed. Persistent price negotiations are necessary to obtain aggressive PE price concessions. The same market fundamentals that supported the 18¢/lb increases earlier this year are now supporting a similar decrease.

60-90 Day: Exports to Asia could be a cause of concern if their PE prices and demand increases. Any improvement in exports demand could halt further domestic PE price concessions.

PP PRICES STABLE?

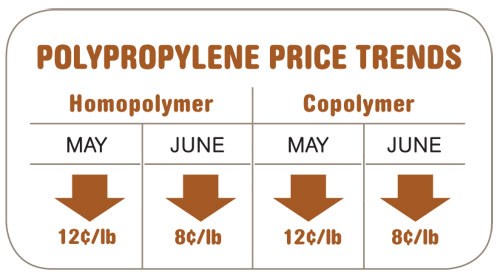

Polypropylene prices dropped a total of 20¢/lb in May and June. The LME short-term futures contract in July for g-p injection-grade homopolymer was 58¢/lb, unchanged from June. As the market bottomed out, suppliers began to limit material moving into secondary markets. Heavy discounting in the secondary market has subsided and prices were stable to slightly higher for most grades.

Suppliers are running harder, with operating rates up to 89.6% and demand rates at 85.4%. Demand has strengthened but suppliers are also fortifying inventories for the hurricane season.

June propylene monomer contract prices dropped 8¢/lb to 55.5¢. July contracts were expected to be 1¢ or 2¢ lower. Spot prices, however rose 2.5¢ in June to 58¢/lb. This was attributed to the unplanned shutdown of Chevron’s Port Arthur, Texas cracker.

Outlook & Suggested Action Strategies

30-Day: Near the start of this month was a good time to buy and restock your inventories. Prices are low and the hurricane season is forecasted to be active.

60-90 Day: We hope to see some price stability through the third quarter. Watch for any more disruptions to monomer supplies, as these could quickly lead to a new price increase.

PS PRICES SOFT

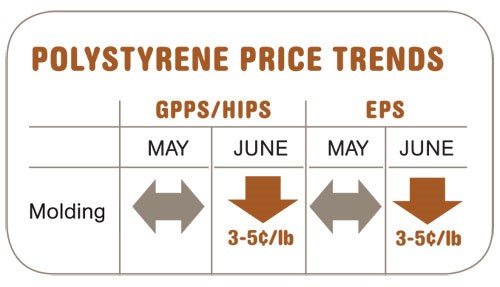

Polystyrene prices dropped 3¢ to 5¢/lb in June and were expected to drop another 4¢ to 5¢ in July. Competitive activity has returned, with Ineos being the most aggressive and America’s Styrenics the least in that regard. By mid-July, wide-spec and spot prices had dropped as much as 8¢/lb for GPPS and 6¢ for HIPS. Suppliers failed to implement June 1 price hikes of 3¢ to 5¢/lb for EPS. Competitive imports returned on a scattered basis, and buying opportunities were expected to arise through third quarter.

Styrene monomer contract prices fell sharply in May and were expected to drop another 4¢ 5¢/lb in June/July. Spot prices have trended down and are now 48¢/lb for June and 47¢ for July.

June butadiene contracts settled 3¢ higher at 92¢/lb. Improved supplies, thanks to imports, limited the increase. Spot prices were dropping, helped by falling oil prices. But supply remains pretty tight, so prices will remain high through this quarter.

Outlook & Suggested Action Strategies

30-Day: With both June contracts for benzene and ethylene dropping, monomer and PS prices were on the way down by 4¢ to 5¢/lb in June and into July. Inventories are in good shape and competition is returning. Explore various supply options, including imports. Buy as needed.

60-90 Day: Prices were expected to sink last month and inventories are expected to build as demand tapers off. Continue to buy as needed. Summer plant turnarounds were starting and must be watched carefully. Inventories will draw down and prices should bottom out. Evaluate your purchasing strategy for the fourth quarter, as price increases are possible.

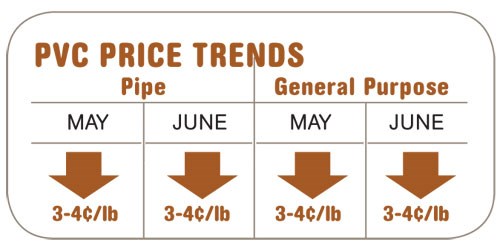

PVC PRICES FLAT TO DOWN

PVC prices dropped 3¢ to 4¢/lb in June, following a similar decline in May, responding to dropping ethylene contract prices. That leaves feedstock cost for PVC still 5¢ to 7¢/lb higher so far this year.

Domestic demand for PVC had been improving with the economy but was dealt a setback as new home sales plummeted by one-third in May, after government subsidies expired. However, new home sales in June showed a 22% increase over May, due to the extension of tax credits to September. Despite the sluggish pipe market, PVC operating rates remain high, as suppliers take the opportunity to use lower cost ethylene. Operating rates could be affected by the startup of the long-awaited second phase (660 million lb) of the expansion from Shintech, which is now expected before October.

Outlook & Suggested Action Strategies

30-60 Day: August PVC prices will be flat or lower as suppliers’ inventories build and ethylene prices drop further. Next month may see some rebound, with prices expected flat or higher. Buy as needed.

Related Content

Prices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreThe Fundamentals of Polyethylene – Part 1: The Basics

You would think we’d know all there is to know about a material that was commercialized 80 years ago. Not so for polyethylene. Let’s start by brushing up on the basics.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More