Resin Buying Strategies: Higher Prices Prevail, for Now

Prices of major commodity resins were on the way up last month, with looming potential for further increases this month, according to purchasing consultants at Resin Technology, Inc. (RTI) in Fort Worth, Texas.

Prices of major commodity resins were on the way up last month, with looming potential for further increases this month, according to purchasing consultants at Resin Technology, Inc. (RTI) in Fort Worth, Texas. Enabling factors include higher raw material costs and tightened resin supplies, due in part to unplanned feedstock outages. Still, the second quarter is generally expected to bring in some relief in price stability. Here’s more of what RTI experts see coming up.

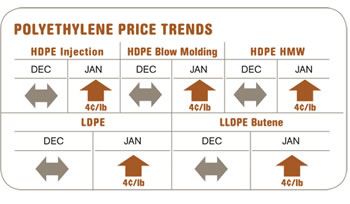

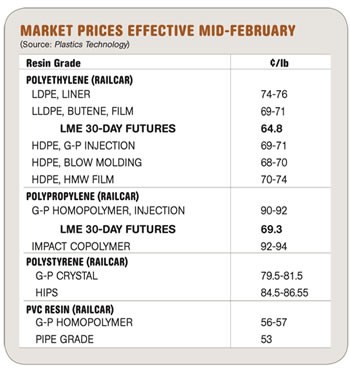

PE PRICES UP, SUPPLIES TIGHT

Higher feedstock costs pushed polyethylene prices 4¢/lb higher in January. Two February price hikes of 3¢ and 5¢/lb were pending at mid-month and appeared to have a pretty good chance of at least partial implementation. The London Metal Exchange (LME) North American short-term futures contract for butene LLDPE film grade in February jumped to 64.8¢/lb from 59.4¢ in January.

Tight ethylene monomer supply is driving PE price increases, resulting from multiple ethylene outages and the impact of an unusually severe winter. For example, LyondellBasell’s Equistar Gulf Coast PE plants have been greatly hampered by extended force majeure conditions at its olefins business. Reduced industry ethylene capacity and the fact that monomer producers are now also buyers have raised prices. Spot ethylene prices rose above 50¢/lb, which could herald a substantial hike in pending contract prices.

Meanwhile, PE availability is tight, and some off-spec is selling at near prime prices. Low processor inventories have spurred some purchasing, and price hikes have prompted some pre-buying. PE operating rates are in the 84% to 88% range, down from last year’s low-90s. Demand rates for PE are 85% to 88% of capacity. Producers’ inventories for HDPE are only 20 to 23 days, but are 40 to 44 days for LDPE and LLDPE.

Outlook & Suggested Action Strategies

30-Day: Until ethylene supplies improve, price challenges will persist. Inventory positioning and strategic buys can help mitigate some of the price pressure. Watch the spot ethylene market for the first sign of supply balance.

60-90 Day: If feedstock costs start to subside and Asian exports do not pick up, expect some price stability.

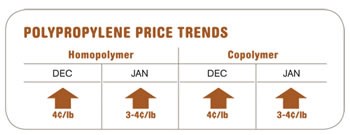

PP TIGHT & TABS RISING

Polypropylene prices rose around 6.5¢/lb last month, mirroring the move in February monomer contracts, which increased to 63.5¢/lb. At least one PP supplier was attempting to tag on an extra 2¢ to the February increase, but market support appeared very unlikely at mid-month. LME’s February short-term futures contract for g-p injection homopolymer jumped to 69.3¢/lb from January’s 58.5¢.

Further PP hikes are likely, due to monomer and polymer supply tightness from planned and unplanned shutdowns of refineries and crackers. Propylene is also short because its relatively low price discourages its production as a byproduct of ethane cracking. LyondellBasell declared force majeure on PP copolymers, while Ineos, Total, and Pinnacle put customers on allocation.

There has been some rebound in domestic PP demand, attributed partly to inventory replenishment and pre-buying in anticipation of higher prices and supply constraints. Limited PP supply has made for a difficult secondary market, leading to higher spot prices—often above contract levels. Resin operating rates are at a record low of 71%, with demand rates at 77%.

Outlook & Suggested Action Strategies

30-60 Day: With limited resin availability, there is not much choice but to buy as needed. February monomer price increases should start to attract some increased production.

PS PRICES PEAKING

Polystyrene prices moved up a total of 10¢/lb by the end of January, owing to increased cost pressure from benzene and ethylene, which together added more than 10¢/lb to resin production cost. The 5¢ PS increase from Feb. 1 had a chance of being partially implemented. However, benzene was on the way back down in February. A rumored 5¢/lb increase for Feb. 15 was not confirmed at press time. EPS prices moved up 4¢/lb in January, and an 8¢/lb February increase was pending. Import prices have risen to domestic levels.

By the end of January, wide-spec PS railcar prices had moved up to 69-75¢/lb for GPPS and 75-80¢/lb for HIPS, though supplies were limited. Distributor railcar costs increased by 5¢ to 84¢/lb for GPPS and 90¢ for HIPS.

January PS plant operating rates rose to 79% from 68% at year’s end, while demand rates appeared to be moving above December’s 85% to 87% level. After the record low inventories of 20 days in November, suppliers have continued to squeeze inventories, despite a stronger than expected uptick in demand.

Outlook & Suggested Action Strategies

30-Day: Benzene prices were falling fast in mid-February. Try to find deals on older PS inventory from the secondary or distributor channel to meet demand as needed.

60-90 Day: Short-term supply problems are possible with demand on the uptick while producers maintain low operating rates. We are also entering the season for many scheduled plant turnarounds. PS resin prices were likely to peak last month and should trend lower as we move into the second quarter. Ethylene and benzene costs will determine how fast PS prices will moderate.

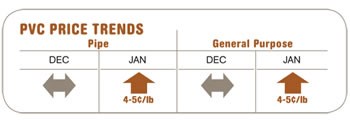

PVC PRICES UP

PVC prices moved up another 5¢/lb by the end of January, reflecting full implementation of the Jan. 15 hike plus the 1¢ increase on Jan. 1. The February 5¢ hike was still up in the air by mid-month. While domestic demand remained slack, rising spot ethylene prices signaled potential implementation of 2¢ to 4¢/lb.

Domestic PVC demand remained weak through the winter, and resin suppliers looked to exports to keep their inventories down. A projected rebound in combined domestic and export demand could produce nearly 5% growth this year. Plant operating rates remain in the low-80s, while demand rates rose to the mid-70s by late January.

Outlook & Suggested Action Strategies

30-60 Day: PVC prices through April depend on the strength of exports as we move into the construction season. Higher PVC prices in Asia and increased demand in Europe could lift exports.

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreFundamentals of Polyethylene – Part 6: PE Performance

Don’t assume you know everything there is to know about PE because it’s been around so long. Here is yet another example of how the performance of PE is influenced by molecular weight and density.

Read MorePrices of All Five Commodity Plastics On the Way Up

Despite earlier anticipated rollover in prices for most of the volume commodity resins, prices were generally on the way up for all going into the third month of first quarter.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More