We are currently witnessing a growing acceptance of advanced chemical recycling technologies as complementary solutions to mechanical recycling. Brand owners in the FMCG (fast-moving consumer goods) sector acknowledge the role chemical recycling can play in unlocking the use of post-consumer recycled (PCR) content and we see several leading chemical companies investing in and/or partnering with advanced recycling technology providers. All eyes are now on the ongoing legislative discussions and deliberations on the status of chemical recycling and mass-balance accounting. The industry is hoping for a well-defined and inclusive policy framework, as it is clear to the entire plastics value chain that achieving plastic circularity will require a whole gamut of solutions.

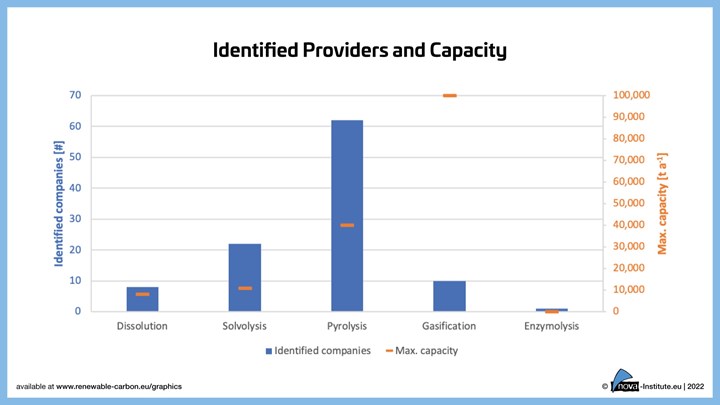

The diversity of advanced recycling solutions is akin to the complexity of plastic waste, which comprises different types of plastics with diverse polymer chemistries. The largest advanced recycling capacities are currently achieved only via thermochemical methods using gasification or pyrolysis. On account of tech maturity, the total number of tech providers, and the average plant size, pyrolysis sits at the top of the list. It can process streams of mixed polyolefin waste and transform them into virgin-equivalent recycled grades for food-contact applications. This has been an important factor driving its growth, with FMCG brands that rely heavily on PE- and PP-based packaging looking to meet the ambitious recycled-content targets for their product packaging.

Pyrolysis technology has been around for a while and is now being fine-tuned to meet the needs of the petrochemical industry. More than 60 pyrolysis technology providers have been identified in the report published in June 2022 by nova-institute in Germany and this list continues to grow. Many are working on enhancing the process and minimizing the environmental footprint. For instance, innovative catalysts are being used to lower the process temperature (and thus the energy demand) and reduce processing time. Advances in pretreatment of waste feedstock and post-treatment of process output are also ongoing to further improve the quality and quantity of the yield.

Widening the Lens: Beyond Pyrolysis

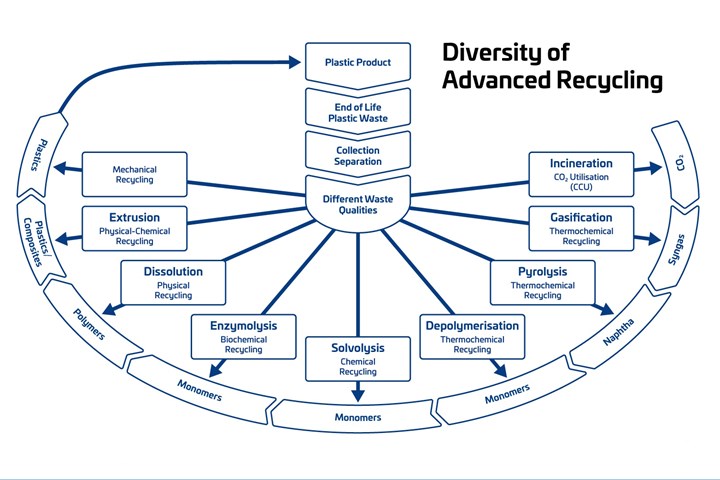

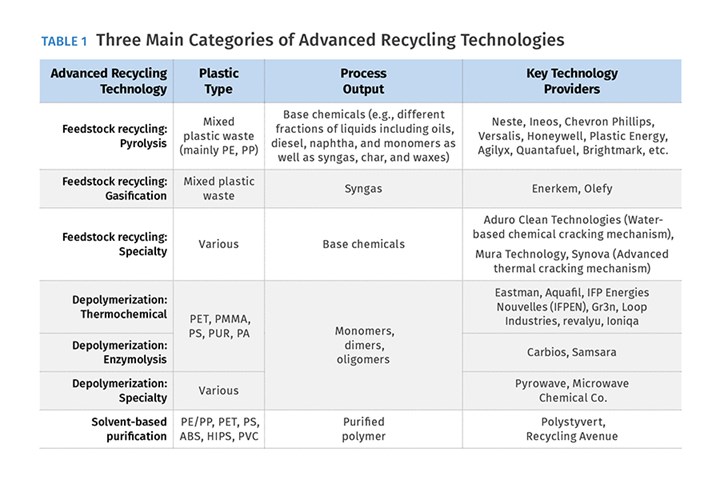

Advanced recycling technologies are largely classified under three broad categories:

• “Feedstock recycling” – e.g., pyrolysis and gasification;

• Depolymerization – e.g., solvolysis and enzymolysis;

• Solvent-based purification – a physical recycling process.

These differ from each other in terms of the types of plastics they process and the resulting process output (see Table 1). In this article, I’ll be focusing on the first two categories of advanced chemical recycling.

Several developments are taking place in each of these segments, and the industry overall has reached a significant threshold. As recently reported by AMI, the global chemical recycling input capacity is close to 1.2 million tons (2.4 billion lb) in 2022, excluding facilities processing post-use plastics into fuels. Many plants are scheduled to fully start commercial operations between now and 2023, and even larger capacities are in the pipeline up to 2030.

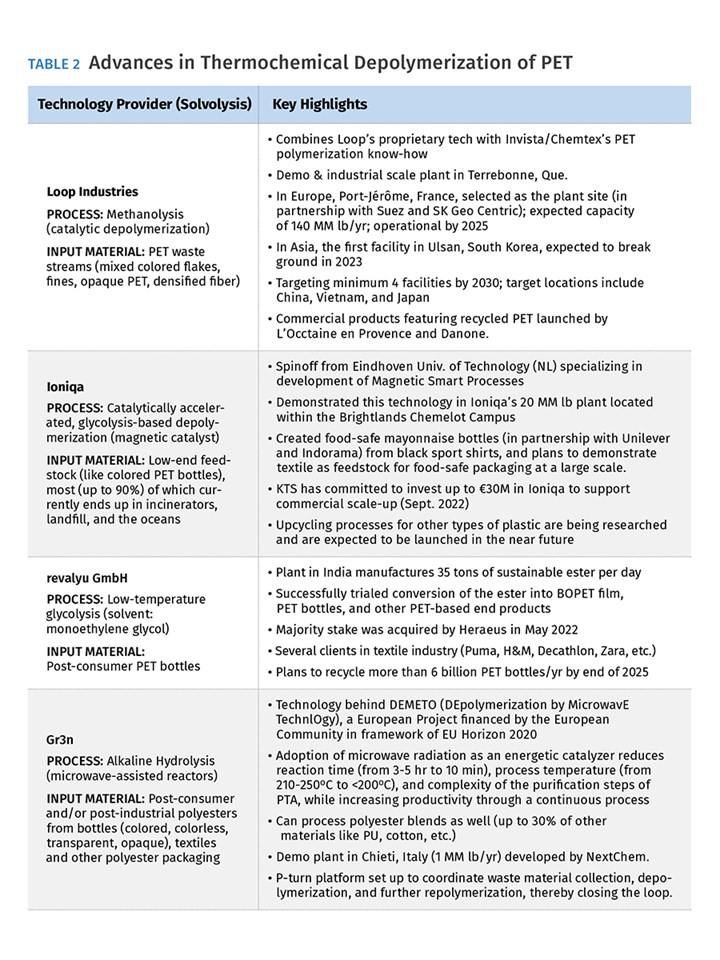

Outside of pyrolysis and gasification, the volumes currently are modest but the number of technology providers, especially in the area of depolymerization, is on the rise. The volumes are expected to grow as well with key industry players like Eastman planning to invest up to $1 billion to set up a 160,000 metric ton depolymerization plant in France, expected to be operational by 2025.

Also, a host of emerging technologies are entering the fray and there’s a lot to watch out for. Many of these technology providers are looking to address the challenges that have been identified with the earlier chemical-recycling processes and in the process have garnered support from leading industry players. Let’s take a closer look at some of the promising developments in this space.

Novelties in Feedstock Recycling

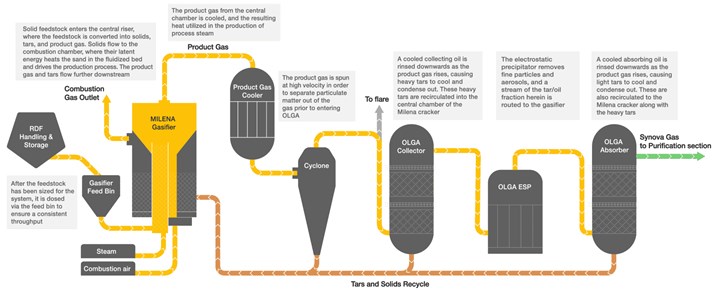

One of the major challenges associated with typical gasification processes is the generation of high tar content. Synova’s patented technology, developed by the Dutch research institute TNO, has no tar waste stream.

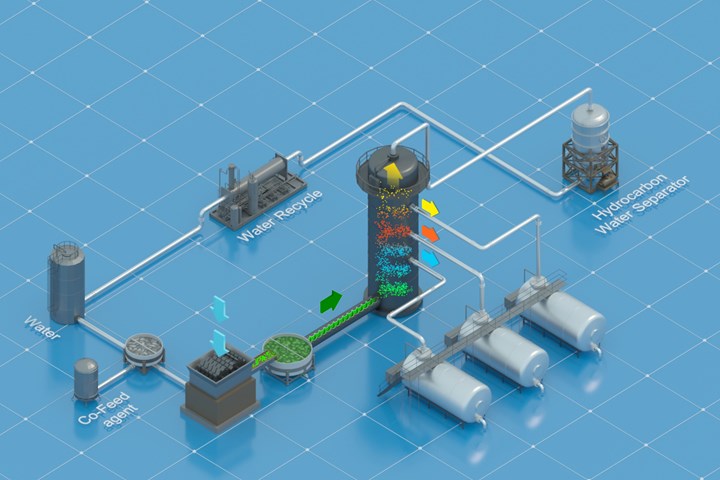

Aduro Clean Technologies has a water-based chemical conversion process that operates at relatively low temperature. (Image: Aduro Clean Technologies)

The process, which has been developed, tested, and piloted over a 15-year span, is based on an indirect gasification concept that combines circulating fluidized-bed, pyrolysis, and bubbling fluidized-bed combustion in one vessel. Waste feedstock for Synova’s process can be (almost) any plastic, together with biogenic material attached, inert materials, and up to 30% water. It produces similar molecules as come from a naphtha steam cracker.

In this process, as shown in the accompanying schematic, the OLGA section removes 99.5% of tars and uses it as a feedstock for the MILENA gasifier/cracker. This completes a highly efficient process that recycles tars and solids.

Another key challenge with gasification is achieving high yields. Developed as part of VTT LaunchPad, a Finnish science-based incubator, Olefy’s patent-pending technology can extract over 70% virgin-grade plastics and chemical raw-materials components from plastic waste. Currently, at the pilot stage, Olefy expects to have its first industrial demo plant operational by 2026.

Next, let’s take a look at an interesting feedstock recycling solution developed by Aduro Clean Technologies in Sarnia, Ont. Last year, Aduro joined the growing list of innovative technologies that are being scaled up at the Brightlands Chemelot Campus in the Netherlands as part of the Chemelot Circular Hub. After a detailed review, Brightlands concluded that Aduro’s technology offers advantages over standard pyrolysis for bringing PE into the circular economy through chemical recycling.

Aduro’s patent-pending water-based chemical conversion process operates at a relatively low temperature (<375°C). Additional benefits include broader feedstock options, high yield, lack of aromatics formation, and the ability to use inexpensive feedstocks and catalysts. At bench scale, the process output does not require hydrotreating and post-processing prior to becoming cracker feed and is projected to have lower capital and operating expenditures.

The pilot-scale reactor is in its final stages of completion. It is designed to handle various plastic feedstocks such as PE, PP, and PS as single-stream materials, followed by a mixture of these feedstock streams. Processing of multilayer plastics containing material “contaminants” such as paper, polymeric materials, aluminum foil, etc. will also be evaluated during the pilot phase. Customer trials at the pilot plant will start soon, and the pre-commercial unit (4400 lb/day) is expected to be commissioned before the end of 2023.

Another company offering benefits over the conventional pyrolysis process is Mura Technology in the U.K. Its proprietary HydroPRS (Hydrothermal Plastic Recycling System) process uses supercritical steam to convert plastics back into oils and base chemicals. Reaction conditions allow high yields of hydrocarbon products, and the use of supercritical water gives a means of rapid heating, which avoids excessive temperatures, minimizing char formation.

Dow has been working in partnership with Mura since 2021, and earlier this year they announced a plan to build multiple facilities in the U.S. and Europe, adding as much as 1.2 billion lb of aggregate advanced recycling capacity by 2030. The first of the five planned industrial plants (with a capacity around 240 million lb/yr at the full run rate) will be set up in Böhlen, Germany, and is expected to be operational by 2025.

The Rise of Depolymerization

Compared with feedstock recycling, depolymerization is more favorable in terms of life-cycle analysis (LCA) on the basis of the shorter loop (waste to monomer vs. waste to feedstock). However, it requires carefully sorted plastic waste streams and currently, most of the technology providers, including Eastman, are focusing primarily on PET waste.

Smartphone cases of Eastman’s Tritan Renew copolyester, made from molecular-recycled PET.

Photo: Eastman Chemical Co.

Eastman’s polyester renewal technology can process materials such as soft-drink bottles, carpets, or even polyester-based clothing and convert them back to their basic monomers using either glycolysis or methanolysis. Eastman’s molecular recycling plant in Kingsport, Tenn., currently uses glycolysis to break down PET. Its facility in France will use a methanolysis unit to depolymerize the waste.

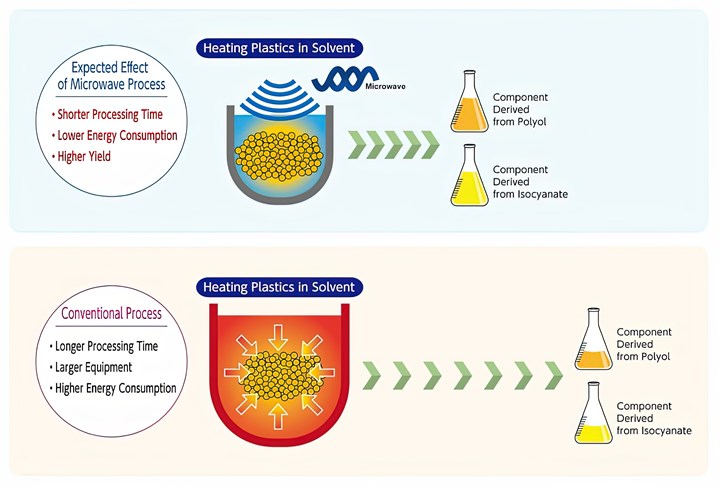

Moving on to microwaves, the next two companies discussed here are looking beyond PET. The Canadian company Pyrowave of Montreal has patented a microwave catalytic depolymerization process for polystyrene (PS) waste and is working together with Michelin – its first licensee – to develop a demo plant by 2023. Initial results point to a liquid yield of nearly 98% together with styrene monomer purity similar to virgin up to 99.8%. Going forward, Pyrowave also plans to develop the platform to accommodate other types of wastes as well.

In Japan, Microwave Chemical Co. Ltd. is actively working with Mitsui Chemical to develop microwave-based advanced recycling processes for depolymerizing specialty polymers such as polymethylmethacrylate (PMMA) and polyurethane (PUR). They are also looking into more complex plastic waste such as automotive shredder residue (ASR) – a mixture of principally PP-based plastics – and thermosetting sheet molding compound (SMC).

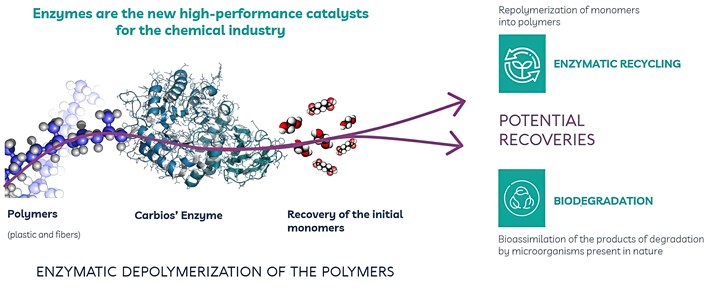

And finally, we move from the advances in electrification of chemical processes to the application of industrial biotechnology in the recycling industry. Though still a niche segment, technology providers such as Carbios (France) and Samsara Eco Pty Ltd. (Australia) have made some promising developments.

Carbios has had a fully operational industrial demonstration plant since Sept 2021, and a reference plant with a capacity of 100 million lb/yr is expected to be up and running by 2025. This is being built in collaboration with Indorama Ventures. Samsara’s pilot plant is already operational and the company has raised capital for its first commercial facility, which will be a 40-million-lb facility for reclaiming polyester in Victoria that is expected to be operational by the end of 2023.

Carbios has been an active participant in consortia and partnerships with FMCG and textile brands to enhance the circularity of PET. Notable partners include L’Oreal, Nestlé Waters, PepsiCo, On, Patagonia, PUMA, and Salomon. The company also recently joined WhiteCycle, a brand-new European project coordinated by Michelin, launched July 1, which aims to develop a circular solution to upcycle complex multi-material waste such as multilayer textile and rubber-goods composites.

The current focus is on PET waste but both Carbios and Samsara Eco are looking to adapt their processes for other plastic types including nylon, polyolefins, polycarbonate, polyurethane, etc.

Many of the technology providers mentioned in this report will be attending the upcoming Advanced Recycling Conference in Cologne, Germany, Nov. 14-15. The two-day conference (a hybrid event) will provide in-depth insight into the latest technology developments, recent LCA studies, and the current challenges and opportunities to scale the new technologies further. It will also be an occasion to get a better understanding of upcoming policy updates and how the industry is working towards building an inclusive ecosystem to achieve circularity of plastics.

ABOUT THE AUTHOR:

Sreeparna Das is an independent consultant and communications and editorial specialist with a Master’s degree in Chemistry and 13 years of experience in the specialty chemicals industry and digital media. She advises leading brands and industry associations across Europe and North America that support the transition towards a circular economy with smart and sustainable solutions. She has published over 30 articles on key topics related to advanced recycling of plastics, circularity of flexible packaging, carbon capture and utilization, the impact of the European Green Deal on specialty chemicals, etc. Contact: sreeparna.das.pro@gmail.com; linkedin.com/in/sreeparnadas/

Related Content

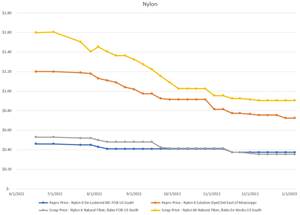

Recycled Material Prices Show Stability Heading into 2023

After summer's steep drop, most prices leveled off in the second half.

Read MoreMultilayer Solutions to Challenges in Blow Molding with PCR

For extrusion blow molders, challenges of price and availability of postconsumer recycled resins can be addressed with a variety of multilayer technologies, which also offer solutions to issues with color, processability, mechanical properties and chemical migration in PCR materials.

Read MoreLooking to Run PCR on a Single Screw? Here’s What to Keep in Mind

Just drop it in and mix it up? Sorry, there’s a lot more to it than that. Here is some of what you need to consider.

Read MoreA Recycling Plant, Renewed

Reinvention is essential at Capital Polymers, a toll recycler that has completely transformed its operation in a short period of time.

Read MoreRead Next

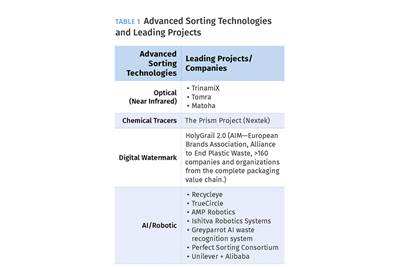

Recycling: What's Ahead in Advanced Sorting Technology

As the industry tries to ramp up recycling, there are several innovative sorting solutions in the offing—ranging from enhanced optical sorting technologies and chemical tracers to advanced solutions based digital watermarks and artificial intelligence.

Read MoreChemical Recycling Poised to Take Off

Investments in chemical-recycling facilities abound as the industry moves closer to the Circular Economy model, accompanied by plenty of new rollouts of packaging made from chemical recycling.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More