Annual Benchmarking Survey of Injection Molders Released

Plastics Technology Top Shops Benchmarking Survey provided both unanimous responses and divided results, but pervasive throughout is the sense of an industry still grappling with the aftermath of 2020’s global pandemic.

As the saying goes, ‘You can’t get everyone to agree on everything,’ and that’s certainly true of any survey, where a single outlier almost always prevents a unanimous consensus on a question. For Plastics Technology’s 2024 Top Shops benchmarking report, however, there were several unanimous results among our honorees that are quite telling about our current batch of Top Shops and the business environment in which they are operating. So, what are some unifying threads running through all 13 of 2024’s Top Shops? Fully 100% use automation (up from 94%), while the percentage running bioplastics was zero (down from 29%), with all offering secondary operations (6% of ’23 honorees provided no secondary operations).

Now in its eighth year, the annual, free and anonymous Top Shops benchmarking survey of injection molders gathers and analyzes demographic data, performance indicators, and business and process strategies. The Intelligence unit of Plastics Technology’s publisher, Gardner Business Media, scores a selection of performance metrics from the questionnaire, with the highest scoring companies named Top Shops for 2024 based on their 2023 operations.

The survey, just like the injection molding industry itself, is taking on an increasingly international flavor. This year’s 13 Top Shops call five different countries home, with eight hailing from the U.S., two from India and one each from Canada, Mexico and Pakistan. The 46 other shops that participated in the survey come from 12 different countries, led by the U.S. (22), India (eight) and Canada (four); with two each from the Czech Republic, U.K. and Turkey and one apiece from Mexico, Sudan, Indonesia, Ghana, Israel and Zimbabwe.

Fully 61% of Top Shops reported utilizing process and production monitoring technologies. Source: Plastikos

Automation as Vital

In 2023’s Top Shops report, honorees largely managed to maintain margins despite historic inflationary pressures. In the 2024 report, respondents noted that while costs had come down somewhat from that peak, they were still high by historic standards. With resin, which is the largest expenditure for any processor, 55% of Top Shops reported paying more for material in 2023, down from 65% the year prior. Prices were the same for 6% — down from 27% — while resin prices were lower for 29%, up from just 18% in 2023.

To combat these stubbornly high costs, without increasing machine rates (which Top Shops did at a lower rate than other survey participants), our honorees turned to efficiency with increased application of automation as the primary productivity-boosting tactic. “Automation is a vital component to our business, and we can’t function without it,” explains Mischa Pillon, president and COO of 2024 honoree Auralites, Weaverville, North Carolina, which runs a lights-out 24/7 production model. To do so, Pillon says his company must design and procure molds meant for long, sustained production runs and operate specialized machinery and equipment that is built to operate unattended. “It’s a costly upfront expenditure,” Pillon says, “but it’s a long-term investment that ultimately allows us to compete in a market where the main producers are typically found in Asia.”

For Abdul Haseeb, business manager at RETAX Technologies, Gujranwala, Pakistan, automation is considered a “cornerstone” of its operations. “The integration of automation has allowed us to enhance precision, increase throughput and reduce human error, resulting in higher consistency in production quality, faster production times and the ability to scale up operations without proportionally increasing labor costs.” RETAX thinks about automation from the moment it quotes a job, according to Haseeb. “For new projects, we assess the feasibility of automation from the outset,” Haseeb says. “Whether it’s through robotic part handling, automated inspection or advanced software for process control.”

Philip Katen, president and general manager of Plastikos, Erie, Pennsylvania, says his company also thinks about automation early and often with new projects, incorporating a design-for-automation element into every new project it considers. “I believe automation is essential to be able to successfully compete both domestically, as well as globally,” Katen says. “Historically, our use of automation throughout our operation has afforded us a distinct competitive advantage to win new business and support, and grow with our existing customers.” Automation also propels a virtuous circle at Plastikos, with Katen noting that the profits it helps secure can be reinvested back into the company’s operations, further boosting efficiency and growth.

Scott Brown, sales engineer at Erwin Quarder, Grand Rapids, Michigan, says his company also takes a maximalist approach when it comes to automation. “We automate as much as possible,” Brown says. “This eliminates human error and ensures consistent delivery of 100% good parts.”

The reliance on automation also helped Top Shops hold the line against prices that eased somewhat in 2023, according to Auralites’ Pillon, but remained above prepandemic levels. “We try to keep our prices as stable as possible by constantly reviewing and evaluating our suppliers as well as identifying ways to improve our efficiency,” Pillon says. “Thankfully, and largely due to automation, we haven’t had to raise our prices in years.”

Bioplastics No, Sustainability Yes

With any survey results, the temptation to draw blanket conclusions is enticing if foolhardy. When told that no Top Shop reported processing bioplastics in this year’s survey, it would be easy to extrapolate that into waning interest in sustainability, but the multifaceted nature of that topic, and some follow-up questions, attest to the ongoing importance of being eco-friendly.

Haseeb at RETAX notes that although his company’s clients expressed minimal demand for bioplastics, “Our customers are increasingly concerned with sustainability, and this is reflected in their interest in reducing material waste and improving energy efficiency.”

At Auralites, Pillon says bioplastics are “tricky” for the company’s products, which require a combination of clarity and flame retardance, as well has high heat deflection and high impact resistance. Interest in the broader concept of sustainability is less “tricky,” however. “Sustainability is always at the forefront of our minds,” Pillon says, “and we try to keep abreast of new developments and products, as well as explore any options that could improve sustainability. Every year, our customers become more and more concerned with sustainability and healthy practices, which we believe to be a positive thing.”

Katen says that, by and large, current bioplastics would fail to satisfy the mechanical and/or chemical resistance properties that Plastikos’ customers’ applications, which include electronics and medical devices, require. That said, he acknowledges that some of its medical customers have asked the company to research bioplastics or compostable material options for nonfunctional parts of disposable devices, with the material’s cost arising as a stumbling block. “I surmise that the higher cost of bioplastics and/or compostable plastic grades is the largest barrier to moving forward in most applications for most customers,” Katen says.

That barrier, however, is not blocking interest in greener operations. “The majority of our customers inquire about our sustainability efforts,” Katen says, “and all of our customers, whether they inquire or not, are interested in those efforts.” At Plastikos, those efforts include a current year-to-date recycling rate of more than 70% and a transition to all-electric molding machines and LED lighting for greater energy efficiency, as well as the use of multiple rain gardens to control storm-water management.

An overwhelming 85% of Top Shops reported having an in-house tool room, including RETAX pictured here, with 61% also undertaking their own mold building. Source: RETAX Technologies

Finding Value in Value Added

As previously mentioned, all Top Shops reported offering some secondary operations, ranging from assembly and decoration to welding, CNC machining and more. This marked a shift from past surveys when at least a few reported providing none of these. Assembly (61%), welding/joining (46%) and machining (38%) led the way, with 15% of Top Shops also providing plating and painting services.

RETAX experienced some pressure to adjust its machine rates downward in 2023, due largely to increased competition, but it kept customers happy by offering more. “By focusing on delivering added value — such as quicker turnaround times and superior quality — we were able to maintain our rates for the most part,” Haseeb says. “The slight adjustments we did make were strategic, aimed at maintaining client relationships and staying competitive in the market.”

Top Shops stayed competitive by also providing value-added services, led by product design, which jumped from being provided by 32% of honorees to 61%; product testing, which more than doubled from 37% to 77%; and shipping/packaging/labeling, which jumped from 53% to 85%.

In terms of design, Pillon says Auralites, which provides from-scratch design and design for manufacturing, considers this service a strength. “Auralites excels in identifying aspects of existing products where material, and ultimately money, can be saved,” Pillon says.

RETAX offers design for manufacturing to optimize existing designs, but its preference is to start from scratch with a new product when possible. “Our strength lies in refining these designs for the realities of manufacturing,” Haseeb says, “including material selection, Moldflow analysis and reducing complexity in the molding process.”

Plastikos deploys a cross-functional team for design for manufacturing, including tooling, quality and process engineering. “Our design-for-manufacturing expertise is most impactful when we partner with a customer up front on a new product or device,” Katen says, “but it can also be very valuable to refine and improve an existing product.”

Grind It Out

Plastikos and others saw some respite in the high costs for everything from materials and labor to utilities and services, which spiked in 2022, but its prices remain high and that — coupled with dulled demand as customers wind down excess inventory ordered during the supply chain interruptions of COVID-19 — equates to a challenging market.

“I’ve frequently described the last 12-18 months as a grind-it-out period,” Katen says, “with softer demand from our customers across the board. Plastikos and Plastikos Medical are still busy, running most of our molding machine on a 24/7 schedule, with a historically high number of transfer projects/molds.” Instead of running at a 9.5, 10 or even 11 level of busy on a 1–10-point scale, Plastikos, like the industry at large, has seen a post-COVID-19 slowdown. “We’re still busy and nicely profitable overall,” Katen says, “but it’s been a tougher grind-it-out period these past 18 months.”

Related Content

Back to Basics on Mold Venting (Part 1)

Here’s what you need to know to improve the quality of your parts and to protect your molds.

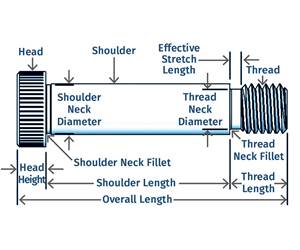

Read MoreWhy Shoulder Bolts Are Too Important to Ignore (Part 1)

These humble but essential fasteners used in injection molds are known by various names and used for a number of purposes.

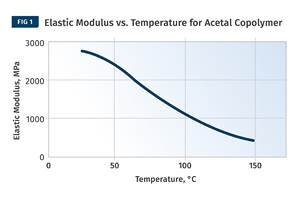

Read MoreThe Effects of Time on Polymers

Last month we briefly discussed the influence of temperature on the mechanical properties of polymers and reviewed some of the structural considerations that govern these effects.

Read MoreWhere and How to Vent Injection Molds: Part 3

Questioning several “rules of thumb” about venting injection molds.

Read MoreRead Next

Top Shops Benchmarking Report: Molding at the Margin

In a world of rising costs and uncertain market conditions, the ability to wring maximum profits from existing business was truly the mark of a Top Shop in 2022.

Read MoreTop Shops Adapt, Evolve and Overcome

Like a stress test on steroids, the pandemic took full measure of Plastics Technology’s Top Shops as it exacerbated or revealed preexisting conditions around labor, the supply chain and more.

Read More2022 Top Shops Benchmarking Survey: Cost Conquerors

Higher costs for materials, wages, utilities and more, coupled with delivery difficulties for both incoming supplies and outgoing production, posed unique challenges to 2022’s class of Top Shops.

Read More