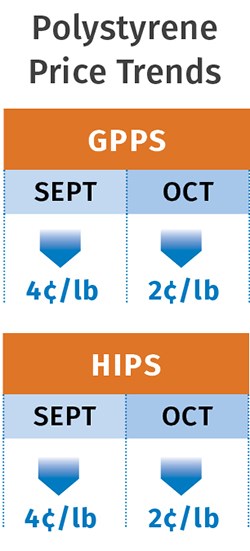

Commodity Resin Prices Heading Down

Falling global feedstock costs and demand destruction concerns are forcing prices downward.

The trajectory for domestic prices of all four commodity resins is downward, as global feedstock costs have been dropping, in some cases significantly, and North American resin suppliers are pricing themselves out of world markets. These are the observations of purchasing consultants at Resin Technology, Inc., Fort Worth, Texas and Michael Greenberg, CEO of The Plastics Exchange, Chicago.

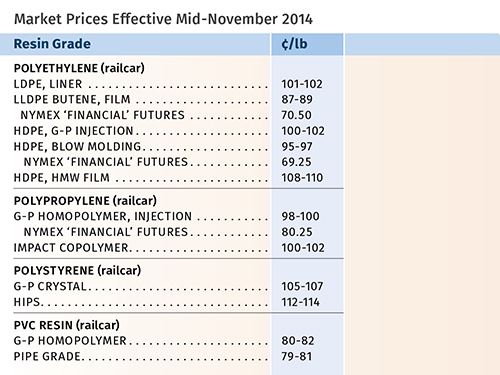

PE PRICES FLAT-TO-DOWN

Polyethylene prices were flat in October and were expected to remain flat through year’s end. “There are no legitimate price increases pending, and chances for price increases in the balance of 2014 and early 2015 are tremendously remote,” said Mike Burns, RTi’s v.p. for PE.

“With spot ethylene dropping in relative free-fall, domestic processors are looking for a share of the savings. Perhaps the elusive price decrease might finally come through in November. The last decrease was 2¢/lb back in November 2012. There have since been 21¢/lb of increases, the most recent of which was 3¢ in September,” reported Greenberg as October came to a close.

The dynamics of the PE market were quickly changed by the unexpected drop in oil and naphtha prices, according to Burns. “Latin America turned to Korea to meet resin needs at a significantly lower price. Regardless of tight resin supplies, North American PE suppliers will need to address the global price that is set by the price of oil and make downward adjustments.”

Burns also noted that distributors have been selling off inventory at reduced or zero margins and that buyers could expect lower prices from such inventory liquidation, not because prime resin suppliers are offering lower prices as yet. He foresaw two market changes that will push resin makers to respond to today’s market conditions: an escalation of imported finished goods such as stretch film and can liners; and the build-up of supplier inventories outpacing demand.

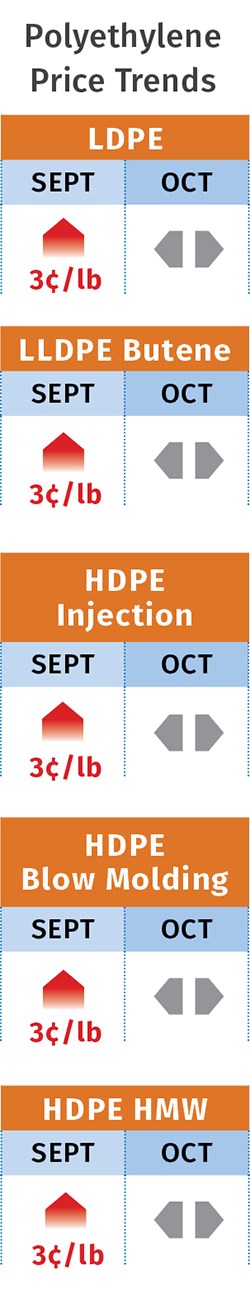

PP PRICES UP BUT NOT FOR LONG

Polypropylene prices moved up 4¢/lb in October in step with the increase in propylene monomer contract prices, which reached a yearly high of 76.5¢/lb, according to Scott Newell, RTi’s director of client services for PP. Driving monomer’s upward movement were planned and unplanned shutdowns that resulted in tight supplies.

With oil prices dropping by nearly $30/bbl since the July peak of over $70, PP prices also have been dropping across the globe—with the notable exception of U.S. domestic prices, which have actually risen. But things were turning around by end of October: Monomer supply was starting to come back, and November monomer prices were expected to come down, with further declines expected this month.

November monomer contract price nominations appeared to be settling 5¢/lb lower as spot prices were dropping. Both Newell and Greenberg ventured that PP prices would drop at least 4¢/lb by November’s end. Newell projected further declines this month, with a double-digit overall decline possible by year’s end. “There’s a good chance that PP prices will go from their peak in October to the lowest price in December,” he noted. He expected a surge of buying activity before year’s end, both because of a need to restock and also to beat a possible price hike in the first quarter when some maintenance outages are planned. Overall for the year, he expected slight demand growth—around 1% over 2013.

“After a flurry of discounted late-October PP sales, the pace of railcar offers diminished. While negative sentiment abounds, the market is far from being oversupplied and actual transaction prices are sliding in a controlled manner. Reseller inventories are fairly light and since producers’ offers are still somewhat expensive, traders are apprehensive about buying material without a customer order in hand,” reported Greenberg at October’s end.

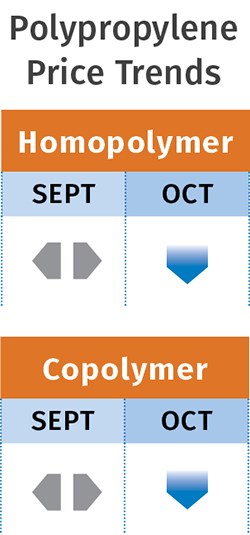

PS PRICES DROP

Polystyrene prices fell another 2¢/lb in October, following the September 4¢ decline, the result of fast-dropping benzene prices. Further price erosion is possible, noted Mark Kallman, RTi’s v.p. of client services.

Kallman noted that the November benzene contract price settled at $3.85/gal, down from September’s $4.22, and spot benzene prices were trading about 10¢/gal lower than contracts last month. Also, the October ethylene contract price dropped by 4¢/lb, and spot ethylene prices have been falling. Moreover, PS demand has been down. Overall,

Kallman projected flat-to-down pricing for PS by year’s end, noting that suppliers have reduced capacity utilization so that supply and demand are relatively balanced. Even with the latest price reductions, PS tabs are still 6¢/lb higher since the start of 2014.

PVC PRICES FLAT-TO-DOWN

PVC prices remained flat through October following the September 2¢/lb increase, but the tide was turning. RTi’s Kallman expected lower prices, by at least 2¢, before year’s end. The total increase in PVC prices this year so far is 11¢/lb.

Key contributing factors include further projected improvement in ethylene supplies, leading to lower contract and spot prices; the seasonal drop in PVC demand; and increased competition from lower-cost offshore PVC due to the drop in global oil prices. North American PVC suppliers are having difficulty finding export markets because of the higher domestic resin prices, said Kallman.

Related Content

Fundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreNew Facility Refreshes Post-Consumer PP by Washing Out Additives, Contaminants

PureCycle prepares to scale up its novel solvent recycling approach as new facility nears completion.

Read MoreDelivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreLead the Conversation, Change the Conversation

Coverage of single-use plastics can be both misleading and demoralizing. Here are 10 tips for changing the perception of the plastics industry at your company and in your community.

Read More