Commodity Resin Prices Rising

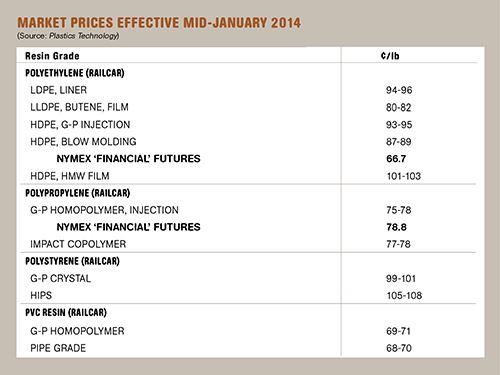

Prices of PP and PS moved up in December and were poised to move up again last month. Price hikes also were on the table for PVC and PE.

Prices of PP and PS moved up in December and were poised to move up again last month. Price hikes also were on the table for PVC and PE. The price moves for PP, PS, and PVC are driven by feedstock costs and some feedstock supply constrictions. Both PE and PP resin supply is on the snug side, even on the reseller market, driven by strong domestic demand. So any processors short on resin heading into the new year were expected to have to pay up for spot material, according to CEO Michael Greenberg of The Plastics Exchange in Chicago and purchasing consultants at Resin Technology, Inc. (RTi), Fort Worth, Texas. The following analysis reflects their views.

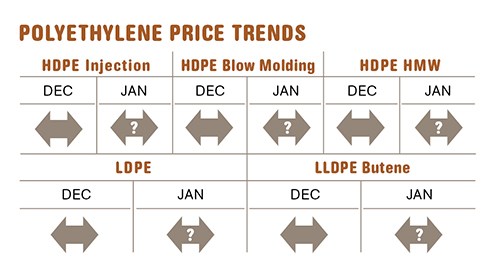

PE HIKE AHEAD

Polyethylene contract prices remained flat through last month but suppliers were aiming to implement a 4¢/lb increase this month. This is the first time in the last several years that PE suppliers issued first-quarter price hikes this late. Mike Burns, RTi’s v.p. of sales for PE, maintains that there are no fundamental drivers for an increase, yet this move changes his outlook from flat-to-downward to flat-to-upward pricing.

Greenberg of The Plastics Exchange reported in the first week of January that spot PE trading was subdued, following prebuying activity in the fourth quarter. RTi advised customers to buy on the spot market in December and avoid January. Burns says domestic demand is likely to be as strong as, if not better than, in 2013, and that processors in major market sectors

have been buying consistently in larger volumes. Burns noted that suppliers cut back exports to Latin America—one of their strongest foreign markets—due to snug supplies.

PP PRICES UP AGAIN

Polypropylene contract prices settled 4¢/lb higher in December, in step with propylene monomer, and were expected to move up another 4-6¢. However the upward momentum in monomer prices slowed by the second week in January, according to both Greenberg and Scott Newell, RTi’s director of client services for PP.

Greenberg reported the spot PP market was fairly quiet and prices were flat. He noted that there were few fresh spot PP offers, but with January resin contracts ready to tick upward, buyers were eager for any decently priced offers.

Greenberg also noted that PP suppliers continue to push for disengagement between monomer costs and PP resin prices, which would allow PP contract prices to respond more freely to supply/demand dynamics.

Newell noted that PP suppliers were able to implement a 1¢/lb average increase in profit margin for January, so PP prices were expected to be a penny higher than the eventual monomer contract settlement for last month.

Supplier inventories were drawn down in the fourth quarter and plant utilization rates for 2013 averaged in the 88-89% range. Said Newell: “I would expect utilization rates to be steady if not higher this year. Domestic demand has been fairly steady and will continue that way.”

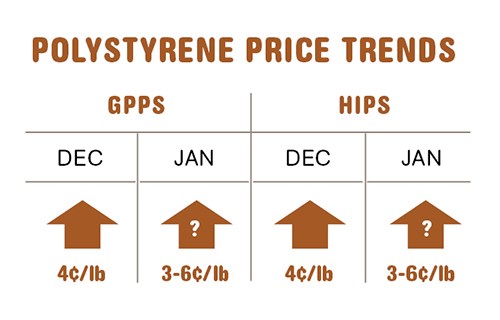

PS PRICES UP

Polystyrene prices moved up 4¢/lb in December and suppliers issued January hikes of 3¢/lb that were then amended to 6¢. Driving this movement was continued benzene price volatility. After jumping 38¢/gal higher in December, benzene contract prices gained another 36¢ in January to reach $4.84/gal.

Mark Kallman, RTi’s director of client services for engineering resins, PS, and PVC, ventured that PS suppliers would implement at least 3¢ of the 6¢/lb being sought last month. He noted that strictly from a cost perspective, suppliers should be asking for 3¢, but two planned and two unplanned styrene monomer plant shutdowns have resulted in monomer tightness. These problems—along with strong monomer exports in the fourth quarter—have contributed to the snug supply.

On the bright side, spot benzene prices, which rose 20¢/gal above contract tabs in December, are now back on par. Kallman foresees easing of benzene prices due to relief from imports and lower oil prices.

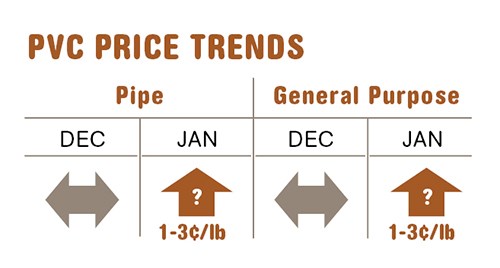

PVC PRICES MOVING UP

PVC prices stayed flat through December, but suppliers were aiming to increase prices by 5¢/lb in two steps—3¢ in January and 2¢ this month. Driving prices upward are supply/demand issues, including the December force majeure of Axiall’s VCM plant in Lake Charles, La., which was shut down following a fire. Higher ethylene monomer prices also had some influence.

RTi’s Kallman points out that in addition to an uptick in export demand last quarter, domestic demand appears to be higher despite the seasonal slowdown. He attributes this to prebuying in anticipation of price hikes.

He predicted that at least a penny of the 3¢ January increase would be implemented, based on the late settlement of December ethylene contract prices, up 2¢/lb. But by mid-January, ethylene spot prices were down 1.5¢/lb. The outcome of January ethylene contracts will affect implementation of the second step of the PVC price increases.

Related Content

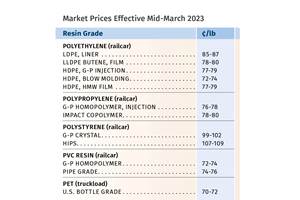

Prices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreFirst Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MorePrices Up for PE, ABS, PC, Nylons 6 and 66; Down for PP, PET and Flat for PS and PVC

Second quarter started with price hikes in PE and the four volume engineering resins, but relatively stable pricing was largely expected by the quarter’s end.

Read MorePrices of PE, PP, PS, PVC Drop

Generally, a bottoming-out appears to be the projected pricing trajectory.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read More