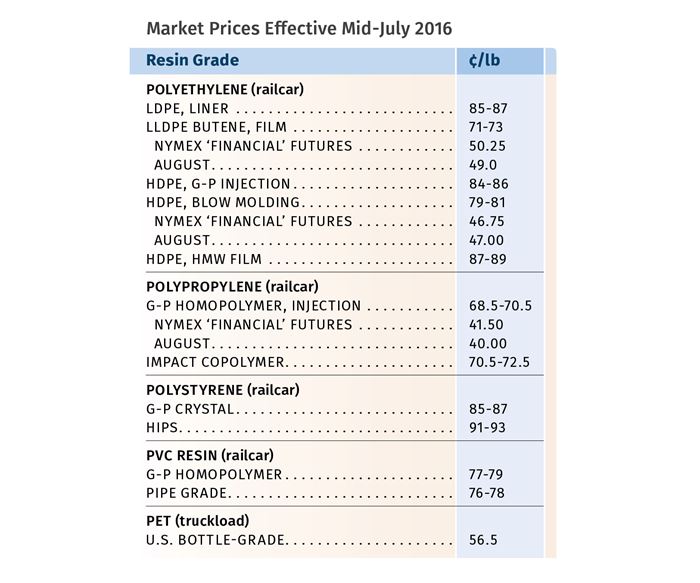

PP, PE Prices Drop While Others Rise

Polyolefin prices ‘calm’ for now, while PET, PS, PVC show a bit more volatility.

With polyolefin supplies exceeding demand, polypropylene prices dropped farther in June, while PE prices were mostly flat but facing strong potential for declines in the July/August time frame. In contrast, PET prices rose and PS and PVC had strong upward potential, driven by higher feedstock costs, unplanned production outages, and, in some cases, an expected upsurge in export demand.

These are the views of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of the Plastics Exchange, Chicago; and Houston-based PetroChemWire.

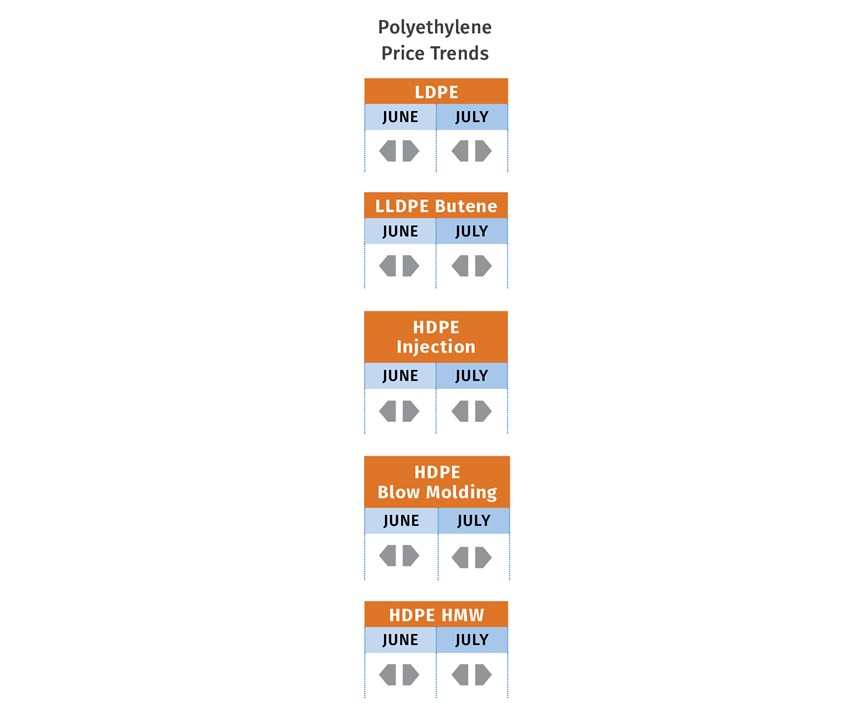

PE PRICES TEETERING

Polyethylene prices were flat through May and June, but held potential to drop as early as last month. Mike Burns, RTi’s v.p. of client services for PE, ventures that PE prices could fall 4¢/lb in July-August, and perhaps another 3¢/lb by the end of September.

In late June, Greenberg reported an uptick in activity in the spot PE market, owing to increased resin availability and lower prices across all commodity grades. PetroChemWire (PCW)reported that spot HDPE supply was “balanced-to-long,” but LDPE and LLDPE were still considered tight.

The combination of a global PE glut and slowdown in demand has the potential to bring on a “new era of oversupply,” according to Burns. “As the supply-demand imbalance continues, we are likely to see the decoupling of PE prices from oil prices.” Nonetheless, Burns says an attempt to raise PE prices, however improbable, could emerge if oil prices climb to $55/bbl. He sees domestic PE demand as pretty strong, though processors generally have been taking a “buy-as-needed” approach.

Meanwhile, PCW reported that LyondellBasell’s force majeure for LLDPE, declared in May because of mechanical problems at its Texas and Illinois plants, continued in June, and a major overhaul of the Morris, Ill., site was to begin last month. PCW also reported that two other suppliers’ LDPE units (one of them Westlake’s) were scheduled for maintenance through July. In Mexico, Braskem started up two HDPE units and a new LDPE unit was due on line last month.

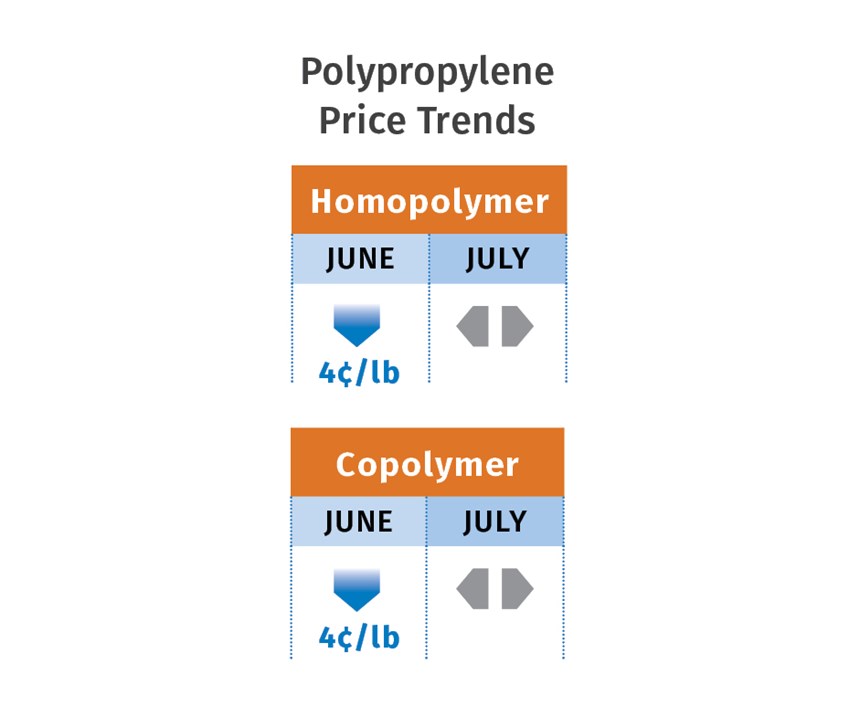

PP PRICES DOWN

Polypropylene prices dropped around 4¢/lb in June, even though June propylene monomer settled 0.5¢/lb higher, at 33¢/lb. The PP price cut was in addition to the 4.5¢/lb combined decreases in April and May, driven by suppliers’ aiming to regain lost market share, according to Scott Newell, RTi’s v.p. of PP markets.

Greenberg notes that June PP contracts that still include a monomer component would be impacted by the slight propylene contract increase, while other buyers were likely to see a lesser decrease for copolymer products—particularly specialty grades. Newell said there’s potential for PP prices to drop a bit more.

Greenberg states, “The PP market has fallen sharply during the second quarter—contracts lopped off a full dime and spot prices eroded even more. While the market could potentially slip some, we think there is limited downside at this point and foresee higher prices ahead once the market bottoms out and begins to recover.”

PCW reports that the arbitrage window for imported PP resin has been closed, but imported inventory remains in the market. Industry estimates are that the combination of resin imports and domestic debottlenecking has added about 1 billion lb to the market so far this year. This occurred “while domestic inventories grew by 200 million lb (excluding imports), a three-year high,” says RTi’s Newell. These sources noted rumors that some suppliers may intentionally throttle back production from the current high operating rates to rebalance supply.

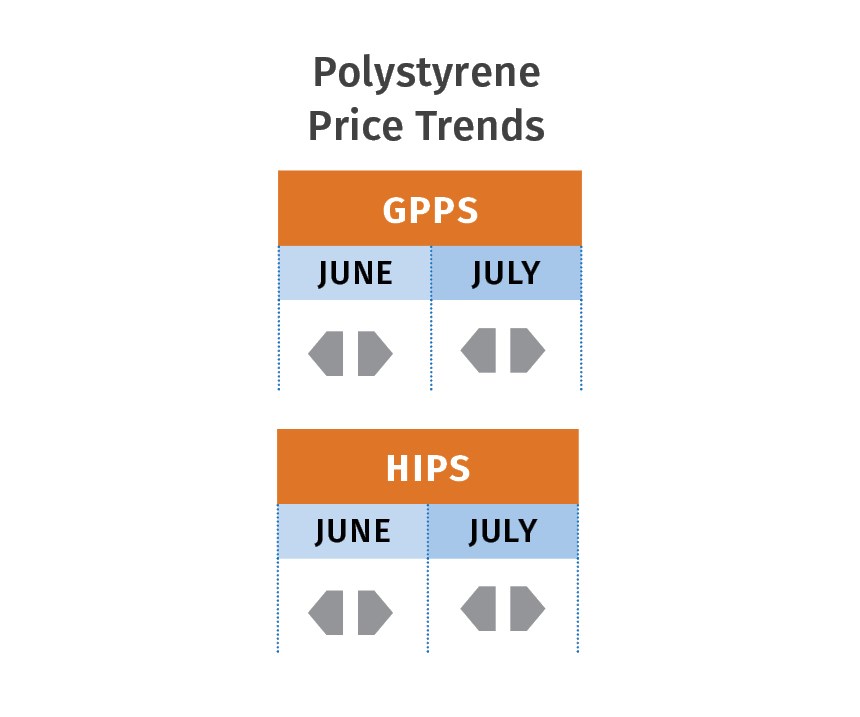

PS PRICES FLAT-TO-UP

Polystyrene prices were flat again in June, but there were driving factors by early July for potential upward movement, according to Mark Kallman, RTi’s v.p. of client services for engineering resins, PS, and PVC. One factor was the July benzene contract settlement, averaging 14¢/gal higher than June’s $2/gal. Also, Total Petrochemical declared force majeure at the end of June for its Carville, La., styrene and PS plant due to an electrical failure. The monomer unit is back up, but the PS unit will take several weeks to restore to operation.

PCW reported at June’s end that PS spot prices were steady. Prime PS demand was described as decent; though reports indicated a slowdown in the second half of June. There was a steady flow of imported HIPS and offgrade HIPS available from domestic suppliers in June. RTi’s Kallman notes that June butadiene contract prices were flat, alleviating further pressure on HIPS prices.

PVC PRICES MOVING UP

PVC prices stayed put for the second consecutive month in June, after moving up a total of 6¢/lb in March and April. However, suppliers were pushing to get their June 3¢/lb increase last month, and RTi’s Kallman saw the possibility of 1-2¢ of that hike going through by month’s end.

Upward drivers included increases in base feedstocks chlorine and ethane, an expected uptick in overseas demand, and force majeure declared by Westlake Chemical at its Kentucky plant. Though not forthcoming about the cause of the disruption, the company said the plant would take longer to repair than originally expected. So, while PVC suppliers kept the market well supplied through May of this year, these negative factors were expected to limit the potential for oversupply.

PET PRICES HIGHER

Bottle-grade prime PET resin in June averaged 56.5¢/lb, up 1.36¢ from May, based on PCW’s PET Daily prices. On July 1, the price was 56¢/lb. Imported PET averaged 51¢/lb in May, down 1.1¢, according to Xavier Cronin, senior editor of PET Daily and Weekly Recycled Plastics reports. He ventured that domestic PET prices would likely be steady in July, buyed by seasonal demand from U.S. bottlers and packaging manufacturers. June PET feedstocks settled modestly higher.

U.S. prime PET supply remains plentiful due to a robust influx of packaging-grade PET from about 20 countries each month. Brazil, for one, has emerged as a major exporter of PET to the U.S. in 2016. In the U.S., M&G Chemicals’ 2.4-billion-lb/yr PET complex under construction in Corpus Christi, Texas, is due on stream in the first quarter of 2017 and will be the world’s largest PET plant.

Related Content

First Quarter Looks Mostly Flat for Resin Prices

Temporary upward blips don't indicate any sustained movement in the near term.

Read MoreDelivering Increased Benefits to Greenhouse Films

Baystar's Borstar technology is helping customers deliver better, more reliable production methods to greenhouse agriculture.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreFungi Makes Meal of Polypropylene

University of Sydney researchers identify two strains of fungi that can biodegrade hard to recycle plastics like PP.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreBeyond Prototypes: 8 Ways the Plastics Industry Is Using 3D Printing

Plastics processors are finding applications for 3D printing around the plant and across the supply chain. Here are 8 examples to look for at NPE2024.

Read More