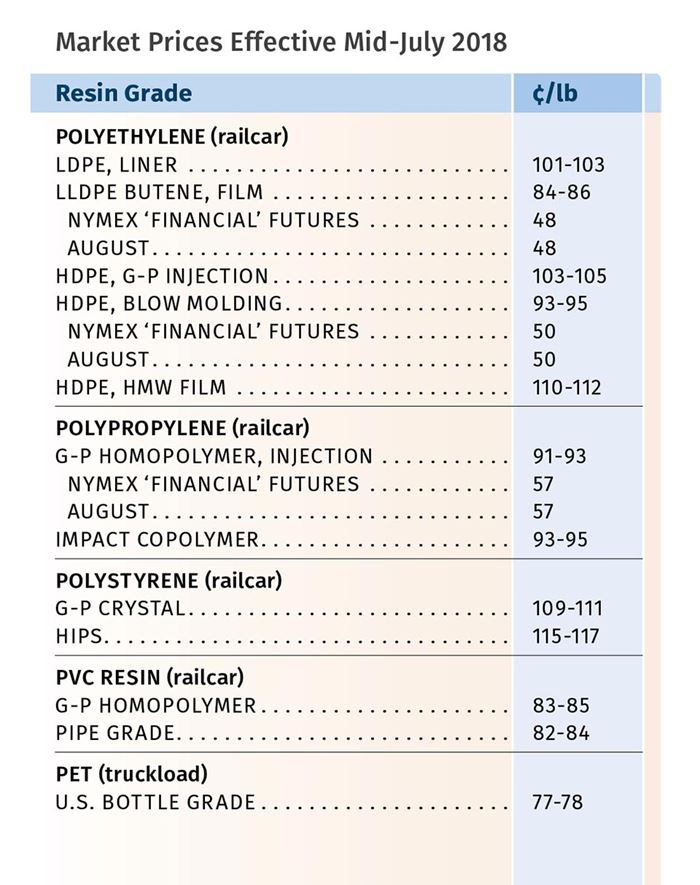

Prices Up for PP & PET; Flat for PE, PS, PVC

The upward trend for PP and PET continued, but at least PP prices likely have peaked.

Lower feedstock prices and generally more balanced supply and demand served to stabilize prices of PE, PS and PVC. In contrast, upward pressure from feedstock costs and stronger domestic and/or global demand resulted in further increases in PP and PET prices. However, the month of June brought some surprises in the price trajectory of nearly all of these five resins, and the potential “trade war” issue loomed over nearly all.

These were the views last month of purchasing consultants from Resin Technology, Inc. (RTi), Fort Worth, Texas; CEO Michael Greenberg of the Plastics Exchange in Chicago; and Houston-based PetroChemWire (PCW).

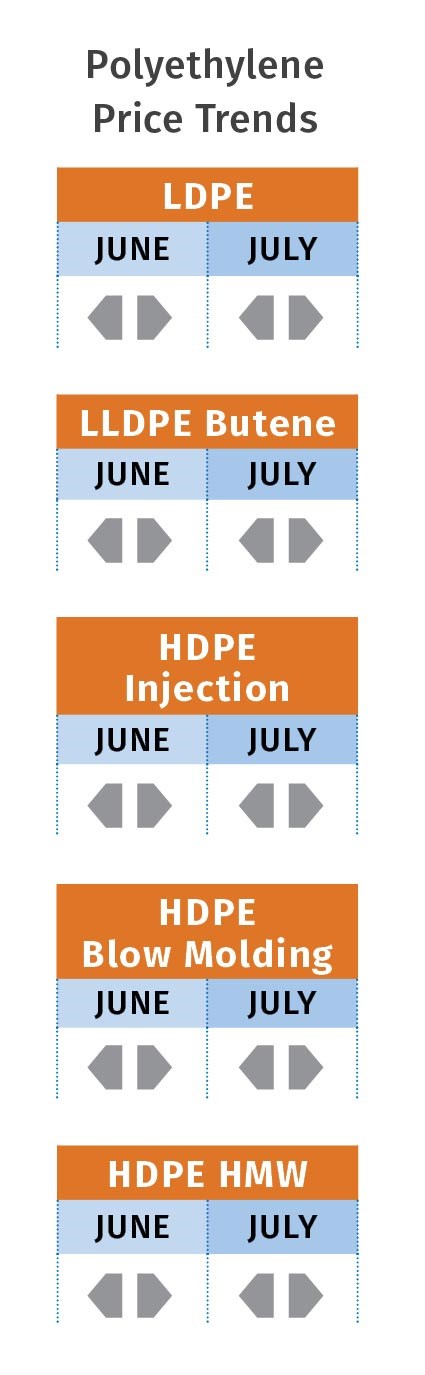

PE PRICES FLAT

Polyethylene prices remained flat in June, despite what was expected to have been a “slam-dunk” 3¢/lb price hike. PCW reported in late June that ExxonMobil Chemical, which led the move, reiterated its intent to increase June PE tabs by 3¢ and announced an additional 5¢/lb for July 1 on certain ethylene-octene and EVA copolymers. But come July 1, Nova Chemical, CP Chem and Formosa pulled back, according to Mike Burns, RTi’s v.p. of PE markets. PCW and The Plastics Exchange’s Greenberg reported similar outcomes, noting that flat contract prices were in line with spot-market prices.

Greenberg noted, “Meanwhile, North American PE suppliers still enjoy a major feedstock cost advantage to facilitate exports, which is how they plan to move the bulk of all this new PE production that seems to be backing up. Also, the whole tariff situation has yet to resolve, maintaining a level of uncertainty, and not just with China.”

RTi’s Burns added that it’s simply a better deal for suppliers to push exports right now—with 65% of exports currently going to Latin America. He also noted that domestic LDPE is still tight, HDPE is snug globally, and he predicted “firm PE prices through September.”

PCW characterized domestic PE demand as healthy and noted that some processors were opting to carry additional inventory as a hedge against hurricane-related disruptions. PCW also noted there were reports that tight supply of catalysts and comonomers butene and hexene could restrict PE output, but no significant supply impacts were confirmed by anyone.

PP PRICES UP

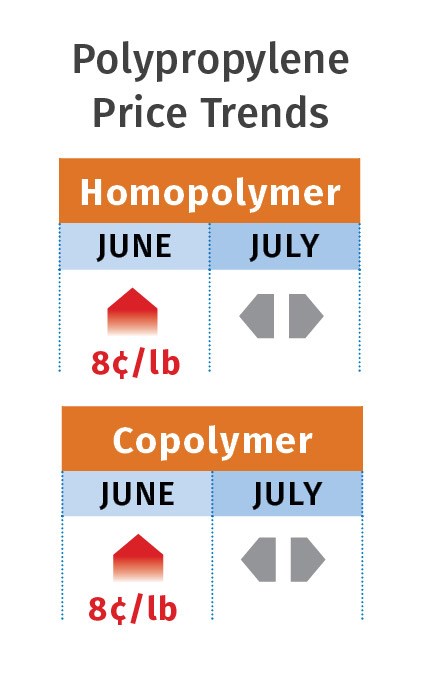

Polypropylene prices moved up 8¢/lb in June, following May’s 7¢/lb hikes, though this time the increase was penny-for-penny in step with propylene monomer contract increases, with no margin expansion added by suppliers. “I think margin expansions have quieted down for the near term,” said Scott Newell, RTi’s vp of PP markets. He ventured that PP prices may have peaked in June and saw prices in July and August as likely to be flat or lower.

Newell noted that monomer contracts had been expected to move up 12-13¢/lb as spot prices climbed rapidly, but those prices began to drop in mid-June. Still, he cautioned that monomer will continue to be an issue, owing to factors like higher oil prices.

Another key issue since the end of 2017 is that ethane has been advantaged in steam crackers, which favors less propylene production. Further tightness has resulted from planned and unplanned propylene outages, along with considerably higher propylene exports to Mexico and Colombia and some to Europe. “It’s been difficult to build a supply cushion, so we remain vulnerable to volatility,” said Newell.

PCW reported spot PP prices as generally firm and supply as balanced to tight, driven by strong demand and June production interruptions at Total and Braskem. It also noted that domestic PP prices were sufficiently elevated over global price levels to invite imports of both resin and finished goods. The Plastics Exchange’s Greenberg characterized the overall domestic PP market as still fairly tight, with branded prime resin prices at a sharp premium to good off-grade resins. He expected an easing of cost-push pressures in July and beyond, as indicated by dropping spot monomer prices.

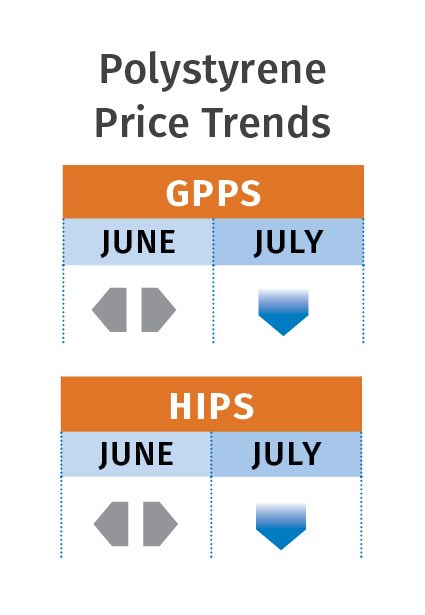

PS PRICES FLAT-TO-DOWN

Polystyrene prices remained steady in June, but downward pricing pressure was underway, with processors aiming to negotiate for price concessions of 2-3¢/lb, based on lower feedstock costs and an improved supply/demand balance, according to both PCW and Robin Chesshier, RTi’s v.p. of PE, PS and nylon 6 markets.

Both cited falling prices of benzene and ethylene. According to PCW, implied styrene production costs based on a 30/70 formula for spot ethylene and benzene were 1.3¢/lb lower toward June’s end—at 30¢/lb. That brought the monomer’s price to more than 2¢/lb below the May 18 implied cost of 32.4¢/lb. Chesshier also cited suppliers’ difficulty in exporting styrene monomer due to tariffs from China. She also cited the recent New York City ruling that upheld a ban on PS foam cups and containers, which is likely to have an impact on PS demand. At the same time, she ventured that July was the last opportunity for processors to get some price concession, as the August-September time frame is typically when suppliers push for increases due to global demand—particularly from Asian appliance markets.

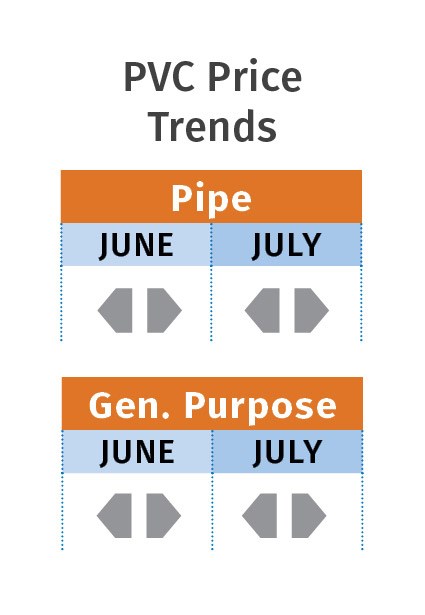

PVC PRICES FLAT

PVC prices remained flat through June, despite good domestic demand and high operating rates—now above 90%, according to Mark Kallman, RTi’s v.p. of PVC and engineering resin markets.

Both he and PCW predicted continued flat pricing for the remainder of the summer, and possibly beyond. Downward pressure from very low ethylene costs has been ignored by suppliers, so far. According to PCW, suppliers appear to be telling processors that high export demand is squeezing the market, while at the same time telling traders that high domestic demand is the culprit. Kallman noted that global PVC demand is not as strong as in previous years and that while domestic suppliers have increased their export activity due to their low ethylene cost, PVC export prices have not increased commensurate with the volume exported. He hazarded that some upward pressure on ethylene contract prices is likely due to higher oil prices and trade tensions. Still, PCW ventured that ethylene capacity additions coming on stream this year—which will boost U.S. ethylene production by 15.3% from current levels—are likely to push PVC prices lower. Another factor is possible imposition of tariffs on U.S. PVC by current importing countries (especially China).

PET PRICES UP

PCW reported increases of domestic bottle-grade PET prices in June by 2¢/lb to 78¢/lb for non-contract spot business, delivered Midwest. Key drivers included higher cost for feedstocks PTA, MEG, and MX, combined with strong demand from the U.S. packaging sector during the high-consumption summer season.

Meanwhile, PET imports from Asia were offered at 78¢/lb, up from 72-74¢/lb in the previous month. PCW reported that imports are rising despite the anti-dumping fees imposed in May on imports from five countries—Brazil, Indonesia, South Korea, Pakistan, and Taiwan—because of a global glut of PET, and the U.S. is one of the largest PET markets in the world.

Related Content

Prices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices Up for PE, PP, PS, Flat for PVC, PET

Trajectory is generally flat-to-down for all commodity resins.

Read MoreFundamentals of Polyethylene – Part 5: Metallocenes

How the development of new catalysts—notably metallocenes—paved the way for the development of material grades never before possible.

Read MoreCommodity Resin Prices Flat to Lower

Major price correction looms for PP, and lower prices are projected for PE, PS, PVC and PET.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read More