Why Long-Glass Molders Are Compounding In-Line

Compounding raw fiberglass directly into thermoplastic molded parts is growing rapidly in Europe, and now it’s coming here. D-LFT, as it’s called, promises to make large parts cheaper and stronger—but with new technological risks and higher up-front investment costs.

In-line compounding and molding of long-glass reinforced thermoplastics is the new alternative to injection or compression molding either pre-compounded long-glass pellets or glass-mat thermoplastic (GMT) sheet. “Direct” long-fiber thermoplastic (D-LFT) compounding and molding is still in its early commercial stages. It accounts for about 16%, or 44 million lb, of the 277-million-lb global market for long-fiber thermoplastics, according to a study by market-research firm BRG Townsend Inc. in Mt. Olive, N.J. GMT accounts for 52%, or 277 million lb, and long-fiber pellets 32%, or 89 million lb. Exclusive of GMT, the LFT market is said to be growing by 30%/yr, and D-LFT even faster than that.

There are at least half a dozen approaches in use—some commercially available, some proprietary. The oldest versions, dating back around 10 years, feed chopped glass fibers 0.5 to 2 in. long into a special extruder. Newer technologies of the last three to five years feed continuous glass rovings, which are cut to length by a cutter or the extruder screw.

Some of the newest versions of D-LFT use a two-stage, screw/plunger injection machine in which a twin-screw compounder replaces the usual single screw. Other D-LFT systems extrude a billet, “log,” or thick sheet, which is placed still hot into a compression press. A variant of the latter extrudes the log directly onto the lower half of the compression mold. (That approach, however, has been discontinued by machine suppliers as being too slow.)

The defining characteristic of all D-LFT technologies is that they require processors to master a complex dual process that combines compounding resin and raw glass with compression or injection molding. “To go to in-line glass compounding you’ve got to run a lot of pounds, and the molder has to be highly technical,” says Robert Constable, co-author of the BRG Townsend study on LFT markets. “The liability switches from the pellet supplier to the molder. I wouldn’t be surprised if some people try this and find it’s way too complex. Heating a sheet of Azdel and slapping it in a mold is a lot easier than compounding and molding in sequence.”

Not only do molders take on responsibility for formulating their own raw material, but the investment costs rise dramatically. Meridian Automotive Systems in Salisbury, N.C., plans to spend around $1 million each for three D-LFT compression systems—and that’s just for compounding and robotic press feeding, not including the press itself. Each system will occupy around 1500 sq ft, not counting the mezzanine for gravimetric feeding and blending. Likewise, a D-LFT injection molding system can cost 80% more than a standard machine.

Why do it?

The first answer is cost savings, and the second is—in general—superior properties. D-LFT compression molding makes big structural parts that are 20-50% less expensive than parts compression molded from purchased GMT. Polypropylene GMT, supplied in the U.S. by GE Plastics under the trade name Azdel, sells for around $1.30/lb. D-LFT parts cost under $1/lb.

“There aren’t many places on a car where so much cost can be removed at once,” says Frank Henning, director of R&D at the Fraunhofer Institute for Chemical Technology in Germany, which supported the early development of two D-LFT processes. “That’s why D-LFT is going to be big in the U.S. America is the most cost-driven car market in the world. They cannot avoid this process.”

Impact properties of D-LFT compression-molded parts may be slightly lower than those of standard GMT. Molders and machine suppliers say average fiber lengths in D-LFT compression molded parts range from 3/4 to 2 in. (19 to 50 mm).

D-LFT compression molding is commercial in Europe and the U.S., making primarily large flat structural parts. Half a dozen large European automotive molders have some 25 lines running now and have placed orders for at least 10 to 15 more. So far there are only two U.S. niche molders practicing D-LFT compression molding, plus one more in set-up stages. Also, there are a handful of R&D machines doing testing and product development.

D-LFT injection is far newer than D-LFT compression. It represents some cost savings versus molding long-glass pellets, but its primary advantage is longer ultimate fiber length and better properties than conventional long-glass injection molding. A key reason for this is that the continuous glass rovings are pulled into the barrel downstream, where they encounter resin that is already melted.

A number of sources say productivity of D-LFT injection is higher than for standard injection of long-glass pellets. Because of the slow plastication required to avoid fiber breakage with long-glass pellets, parts that require cycle times of over a minute reportedly can be molded in 30 sec or less with D-LFT injection (or compression) systems.

D-LFT injection makes parts that require more flowability but less strength than D-LFT compression does. Another advantage for D-LFT injection molding is that it avoids big punch-outs in parts and the resulting scrap. Ultimate fiber length from D-LFT injection is said to be 7 to 12 mm, shorter than for D-LFT compression processes but much longer than is obtained by injection molding long-fiber pellets in a standard machine.

D-LFT compression processes are growing most rapidly in Germany. In France and the U.S., where thermoplastic compression molding is less well established, automotive markets have tried to get higher impact strengths using long-glass injection molding. But with long-glass pellets, no matter what the starting glass length is, the glass comes out about 1/8 to 1/4 in. (3.2 to 6.4 mm) long in the finished parts, according to Randall Lawton, president of C.A. Lawton Co., which sells a D-LFT compression system. That’s shorter than the final glass length in either D-LFT injection or compression molding. (A source at Ticona says its Celstran long-fiber pellets produce parts with longer than 1/4-in. fibers “on a regular basis” but would not specify what proportion of fibers reach that length.)

D-LFT of either type brings another advantage. It easily recycles punchouts and other scrap that conventional GMT molding cannot reuse. D-LFT can even recycle conventional GMT scrap, an advantage to molders that use both processes.

Where does D-LFT fit?

Evaluating the costs versus benefits for a variety of different D-LFT approaches is not simple. First, there is the matter of defining how long “long” glass is—in the finished part, which is the only measure that counts. Second, comparisons can easily be confusing. One must be careful to distinguish between D-LFT injection, long-glass pellet injection, and even injection molding traditional short-glass pellets.

Then there are D-LFT compression and compression molding of purchased GMT—of which there are two very different kinds, containing either chopped fibers or continuous-fiber mat. Then again, D-LFT compression can be based on continuous fibers, chopped fibers, or long-fiber pellets. Choosing among all these alternatives will ultimately depend on issues of cost, productivity, and the mechanical properties re-quired of the finished part.

Matt Miklos, product manager for Verton long-glass pellets at LNP Engineering Plastics, cautions molders to recognize that ultimate glass length in a part cannot be expressed accurately as a simple value or range, but as a statistical distribution or histogram. The shape of that curve is determined by the machine, mold, part configuration, and process conditions used. Even proper molding of long-glass pellets requires machine and process modifications, such as low-shear screws with no barrier or mixing sections, larger orifices, and lower screw speeds.

William Ferrell, technology and production manager at PPG Industries in Pittsburgh, which supplies roving to all long-fiber markets, does not believe D-LFT competes with long-fiber pellets. “They service such different applications. If anything, in-line LFT will continue to replace die-cast metal parts and parts requiring extensive assembly.” (PPG is a partner with GE in Azdel Inc., which produces Azdel sheet for sale by GE.) But LNP’s Miklos says, “In some cases, we go after the exact same parts. There will be some overlap in changing markets.”

A number of processors and equipment suppliers say that, as a broad generalization, the more continuous the process of feeding and compounding the material, the less damage is done to the glass fibers, whether the technology starts with roving or chopped fiber or goes into a compression or injection mold. Their reasoning is that the more pressure variation and turbulence the fibers are exposed to in the melt, the shorter they will end up in the part.

“The choices aren’t necessarily a quality issue. Some parts need 25-mm glass, some need more,” says Heinrich Ernst, sales manager of Dieffenbacher GmbH in Germany. “You must know what impact strength you need to achieve, then decide the length of fibers and how best to feed the mold.” He adds that the flip side of having longer fibers (at least longer than 1 in.) is that they flow more slowly and retain more heat than shorter ones.

Some sources say only 10 to 15 mm is the preferred fiber length to fill out thin, flat parts like car underbody panels. Such fibers also cause less warpage than longer 20-25 mm glass, says Siegfried Kupper, head of R&D at RKT Kunststoffe, a global automotive GMT and D-LFT compression molder based in Koengen, Germany.

D-LFT injection molding

There have been two main proponents of D-LFT injection molding with piggyback twin-screw compounders, both of which showed their systems at last fall’s K 2001 show in Dusseldorf. One is Krauss-Maffei, which offers systems from 715 to 5940 tons. The extruder operates continuously with the aid of a melt accumulator that feeds the injection system. K-M builds the twin-screw section itself, though its initial systems used virtually identical designs from sister company Berstorff.

The other factor was Husky Injection Molding Systems, which built a demonstration system with a 330-ton press and a Coperion Werner & Pfleiderer twin-screw on top of the injection unit. Husky has discontinued this program due to “lack of serious customer interest.”

D-LFT injection is commercial at two European automotive plants, both using Krauss-Maffei systems. Six lines are in operation: three in France, two in Germany, and one on consignment at Delta Tooling Co. in Auburn Hills, Mich., which is using it for customer trials. Faurecia in Audincourt, France, was the first molder to go with D-LFT injection. It bought the machine shown at K 2001. Faurecia now has three D-LFT injection lines and a fourth on order. It uses D-LFT to make Peugeot underbody panels and other automotive parts. Krauss-Maffei is also setting up a 2970-ton lab machine for D-LFT trials in Munich.

D-LFT compression molding

Most large European automotive groups making D-LFT compression parts originally compression molded GMT and still run both processes. Often a D-LFT molded part can run in the same mold as the GMT part. “We’re making less expensive parts that are higher quality,” notes Bernd Wulf, head of the Center of Excellence for Plastics and Composites at Rieter Automotive Heatshields AG in Sevelen, Switzerland. “The D-LFT technology is a major factor in increasing market share.” Rieter has two years’ experience with D-LFT on two Dieffenbacher lines and plans to install another two soon.

Berstorff offers a system for continuous production of GMT-like material. A corotating twin-screw extruder is modified with a pair of rollers to separate continuous roving strands, heat them, and wet them with melt before pulling them into the intermeshing screw section.

Berstorff has built two compounding extruders capable of D-LFT, though neither is used with a mold. One is in Berstorff’s lab in Germany. The other has been at Quadrant (formerly Symalit) in Lenzburg, Switzerland, since October 2000. It makes a lower-cost GMT sheet for sale to compression molders. Interestingly, Quadrant took this route in response to competition from D-LFT compression molding.

Composite Products Inc. (CPI) in the U.S. developed the earliest known D-LFT compression process in 1989 and commercialized it in 1991. CPI uses two single-screw extruders in-line. One melts PP, the other preheats cut fiber with a low-shear screw and combines it gently with the melt. The compound then flows to an accumulator where a piston pushes it out, and then it is transferred to a compression mold.

CPI has three production D-LFT lines. It has made a 3 x 5 ft back panel for Dodge Ram pick-up truck cabs for seven years. More recently, it molded door surrounds and front headers for the Jeep Wrangler and will soon make running boards for a Tier One automotive supplier. CPI is building a fourth D-LFT system, which will use a new long-fiber process called Woodshed that uses a wire-coating type die to apply melt to rovings. Inventor Ron Hawley calls this latest approach “pushtrusion.” It eliminates the accumulator and piston and can fill standard injection molds.

In 1995, Volvo in Sweden licensed CPI’s D-LFT compression process. Volvo wanted long-fiber parts without the high price of GMT sheet. Volvo compression molded car underbody panels and front ends, as well as a truck-cabin interior box.

Volvo later spun off its D-LFT compression operation to Polytec Composites Sweden AB, an Austrian-based automotive GMT molder. Polytec’s new D-LFT programs include an engine shield for Volvo. Polytec and Volvo are experimenting with nylon filled with 30-mm glass fibers to compete with SMC. Polytec is also developing a cutter to cut rovings beside the D-LFT machine instead of buying more costly chopped glass. Polytec doesn’t like letting the extruder screw cut the fiber because it believes that produces more random fiber lengths (a point twin-screw extruder makers dispute).

CPI’s process was recently licensed to Decoma International in Mississauga, Ont., which will start D-LFT compression molding later this year.

Composite Technologies Co. in Dayton, Ohio, acquired plasticator technology from the former Rose Extruder Co. in Milwaukee in 1993, and developed and patented its own D-LFT compounding process in ’94. This uses a 34:1 L/D reciprocating single-screw plasticator and cut fiberglass to feed compression molds. CTC runs eight D-LFT compression lines making a range of non-automotive composite parts using recycled glass from glass-mat edge trim and recycled TPO from car bumpers. It custom molds parts like backboards for basketball hoops for Huffy Sports and carrier shelves. CTC licenses C.A. Lawton Co. to use its plasticator and also does customer trials for Lawton. CTC also recently sold a system to an unnamed U.S. molder for delivery later this year.

Coperion Werner & Pfleiderer has supplied its corotating twin-screw compounders for D-LFT compression as well as injection. CW&P says it has 12 compounders running roving for D-LFT compression molding. Seven of them are retrofits to Dieffenbacher GMT presses. One extruder often supplies two compression molds. One to be installed soon at Rangerplast in Abiata Prianza, Italy, will feed three molds.

RKT is the biggest user of W&P’s D-LFT compounders. It has five systems running in Germany, Brazil, Spain, and Mexico. The line in Pueblo, Mexico, started up six months ago to supply parts for Volkswagen-Mexico. RKT expects in the next few years to install a D-LFT compression line at its AKsis unit in Gastonia, S.C. RKT molds parts like underbody panels, sound shields, and front-end carriers. Company sources say its process yields parts with glass fibers of 2 to 25 mm, but mostly in the range of 8 to 10 mm.

Dieffenbacher’s newest D-LFT technology uses a corotating twin-screw from Leistritz to melt the PP. Preheated continuous rovings are spread apart on rolls and pulled into a short second twin-screw that combines the glass with melt. The screws cut the glass into random lengths of up to 80 mm. This compound then goes through a sheet die and is cut into blanks and fed to a compression mold.

Dieffenbacher has sold 17 D-LFT compression systems, 10 of which are in operation—nine in Europe and one in the U.S. (at Meridian). It will deliver another to Delphi Automotive Systems in Troy, Mich., in August. (An existing Dieffenbacher R&D system at Delphi molds long-glass pellets.)

Polymer-Tech GmbH in Bad Sobeinheim, Germany, was the first to use Dieffenbacher’s D-LFT compression process. It makes underbody panels and truck panels. Other D-LFT lines are at Rieter in Switzerland and the Czech Republic, and at Faurecia Interior Systems in Worth, Germany, which makes an instrument-panel carrier. Dieffenbacher also has a 1500-ton lab system in Germany capable of 1300 lb/hr production for customer trials.

Intier Automotive, Magna’s auto-interiors operation based in Newmarket, Ont., has a proprietary D-LFT compression process in development.

Johnson Controls Interior in Grefrath, Germany, uses a D-LFT process called Fibropress, which it developed in-house in 1998.

Three years ago, C.A. Lawton bought a process for compression molding with long-glass pellets from Kannegiesser in Germany and converted it to D-LFT using glass rovings. Lawton’s process feeds continuous glass into a 36:1 corotating twin-screw extruder from Leistritz or Entek Extruders. The composite is then fed into a CTC plasticator for final mixing and metering with a reciprocating screw. Lawton has one unit at the Southern Research Institute of the Univ. of Alabama in Birmingham. A second D-LFT compression unit was delivered to Rieter in the Czech Republic in 2000 to mold underbody panels for a VW car.

Related Content

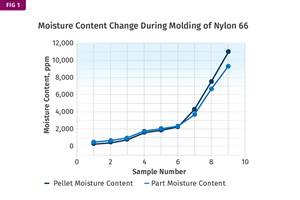

What's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MoreTracing the History of Polymeric Materials, Part 26: High-Performance Thermoplastics

The majority of the polymers that today we rely on for outstanding performance — such as polysulfone, polyethersulfone, polyphenylsulfone and PPS — were introduced in the period between 1965 and 1985. Here’s how they entered your toolbox of engineering of materials.

Read MorePrices for All Volume Resins Head Down at End of 2023

Flat-to-downward trajectory for at least this month.

Read MorePrices Bottom Out for Volume Resins?

Flat-to-down trajectory underway for fourth quarter for commodity resins.

Read MoreRead Next

Making the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreSee Recyclers Close the Loop on Trade Show Production Scrap at NPE2024

A collaboration between show organizer PLASTICS, recycler CPR and size reduction experts WEIMA and Conair recovered and recycled all production scrap at NPE2024.

Read MorePeople 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read More