Potential Nylon 66 Supply Shortage?

Ascend Performance responds to this issue.

In mid-June, we received information from resin distributor PolySource, Independence, Mo., regarding potential nylon 66 shortages and escalating prices. Some historical background on the nylon 66 supply chain was included, with an emphasis on adiponitrile (ADN), which is used in the production of primary nylon 66 component hexamethylene diamine.

PolySource addressed nylon 66 resin alternatives—including nylon 6, aliphatic polyketone (POK), PPA and PBT, as well as an overall outlook regarding ADN capacity expansions that may not meet market demand until 2021, at earliest.

I posted a blog on the topic and we asked industry sources across the supply chain to respond (we also reported on this in PT’s July issue). Houston-based Ascend Performance Materials —the largest fully-integrated supplier of nylon 66 in the world—offered a response to PolySource, providing a different perspective on ADN and nylon 66. Ascend Senior Business Director Dharm Vahalia provided a response for his company, taking issue with some of the points made by PolySource. Dharm Vahalia:

Last year, an analysis of ADN supply caused a bit of ruckus. The central argument was this: ADN—a precursor to hexamethylene diamine, one of the two components in nylon 66—is manufactured in four world-scale plants, and any disruptions in those plants will affect the supply of nylon 66. Nylon 66 is becoming increasingly important to several industries, especially automotive. Nylon 66’s unique properties and value proposition have made it a critical material in vehicle lightweighting and electrification.

Meeting the projected 3-4%/yr growth has been the focus of Ascend Performance Materials for a number of years with capacity expansions announced through 2021. Other producers have announced expansions as well. While we recognize the concern surrounding nylon 66 supply, the hysteria exhibited in a recent article in Plastics Technology is unfounded. It mistakes one analyst’s hypothetical concern for a current reality. In fact, many of the claims made in that article are not based on any careful analysis of the market. Let’s start with the first claim regarding the process by which ADN is manufactured:

● To say that all ADN capacity in the U.S. is based on the DuPont process is incorrect. There are two routes to ADN, utilizing either butadiene (C4) or propylene (C3) as feedstock. DuPont developed the C4 route, which is used to produce over half the ADN in the world. The C3 route, on which Ascend Performance Materials’ production is based, supplies the rest of the world’s ADN. All of Ascend’s manufacturing is in the U.S., and it does not use the DuPont process.

● The next claim in the article that “chemical plants only make money when they are run at full capacity,” is frankly beyond comprehension. In truth, many factors affect the profitability of a plant, chief among them is the reliability of the production units. This claim is further refuted by the ability to increase capacity through debottlenecking, meaning that the process being debottlenecked was previously running below capacity.

● The claim that ADN supply is “dramatically” below demand and will continue to be for at least three years is unsupported by third-party analysis. The largest producers of ADN, including Ascend, have announced plans to increase capacity. Demand for ADN is projected to grow approximately 5%/yr. Ascend has consistently grown annual capacity at double that rate and has announced plans to continue doing so through 2021.

● Nylon 66 demand is projected to grow 3-4%/yr, fueled by growth in existing applications and the development of new ones. Ascend has announced plans to grow production capacity by 10-15%/yr.

● Finally, it is misleading to say that nylon 6, POM, PPA or PBT can “easily replace” nylon 66 because they meet cost, performance or processability specifications. Yes, some qualities of nylon 66 can be matched by a different polymer, but nylon 66 is a superior choice for delivering all three. With nylon 66, component manufacturers needn’t sacrifice processability or their bottom line to meet heat resistance, hydrolysis resistance, flame retardance or impact weathering specifications.

● Supply is a valid concern for any business, and we welcome any questions about how we plan around disruptions to continue serving our customers. Innovating new technologies to displace existing ones is an admirable way to gain business, but making claims against a competitive product without legitimate supporting data is an area where the industry needs to improve and be more transparent.

Related Content

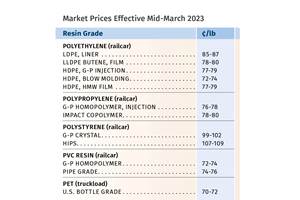

Prices of Volume Resins Generally Flat or Lower

Exceptions in early March were PP and PS, which moved up solely due to feedstock constraints, along with slight upward movement in PVC and PET.

Read MoreGeneral Polymers Thermoplastics to Further Expand Distribution Business

NPE2024: Following the company’s recent partnership buyout, new North American geographic territories are in its sight.

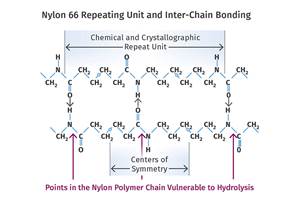

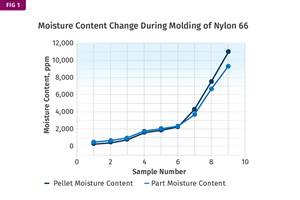

Read MoreWhat is the Allowable Moisture Content in Nylons? It Depends (Part 1)

A lot of the nylon that is processed is filled or reinforced, but the data sheets generally don’t account for this, making drying recommendations confusing. Here’s what you need to know.

Read MoreWhat's the Allowable Moisture Content in Nylons? It Depends: Part 2

Operating within guidelines from material suppliers can produce levels of polymer degradation. Get around it with better control over either the temperature of the melt or the barrel residence time.

Read MoreRead Next

People 4.0 – How to Get Buy-In from Your Staff for Industry 4.0 Systems

Implementing a production monitoring system as the foundation of a ‘smart factory’ is about integrating people with new technology as much as it is about integrating machines and computers. Here are tips from a company that has gone through the process.

Read MoreMaking the Circular Economy a Reality

Driven by brand owner demands and new worldwide legislation, the entire supply chain is working toward the shift to circularity, with some evidence the circular economy has already begun.

Read MoreFor PLASTICS' CEO Seaholm, NPE to Shine Light on Sustainability Successes

With advocacy, communication and sustainability as three main pillars, Seaholm leads a trade association to NPE that ‘is more active today than we have ever been.’

Read More